Your Illinois real estate transfer tax calculator images are ready. Illinois real estate transfer tax calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Illinois real estate transfer tax calculator files here. Get all royalty-free photos.

If you’re looking for illinois real estate transfer tax calculator images information linked to the illinois real estate transfer tax calculator topic, you have pay a visit to the right site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

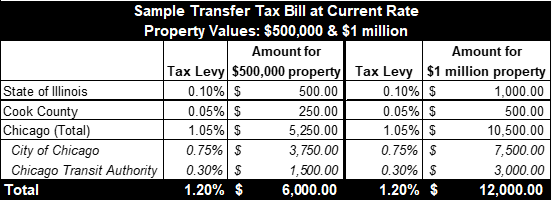

Illinois Real Estate Transfer Tax Calculator. The assessed value of property in most of Illinois is equal to 3333 one-third of the market value of the residential property though it may be different in certain counties. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes. Transfer Taxes stamps State of Illinois Transfer Tax. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged.

Real Estate Taxes Vs Property Taxes H R Block From hrblock.com

Real Estate Taxes Vs Property Taxes H R Block From hrblock.com

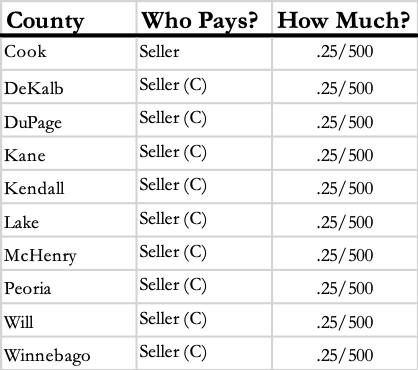

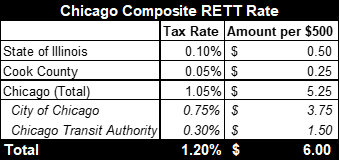

The City of Chicago. In our calculator we take your home value and multiply that by your countys effective property tax rate. City of Chicago Form 7551 Real Property Transfer Tax Declaration. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4. Cook County Transfer Tax. Multiply the calculated number by the marginal rate for that bracket found using the.

The tax is imposed on the privilege of transferring title to real estate or a beneficial interest in real property that is the subject of a land trust in Illinois as represented by documents deed or trust agreement filed for recordation.

Or 3 a controlling interest in a real estate entity owning property in Illinois. Cook County Property Tax Rates. Houses 1 days ago Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. Transfer Taxes stamps State of Illinois Transfer Tax. 2 a beneficial interest in real property located in Illinois. Transfer Tax Calculator Chicago Real Estate Lawyers Law.

Source: pinterest.com

Source: pinterest.com

Multiply the calculated number by the marginal rate for that bracket found using the. TheState of Illinois the County and the local municipality ie. Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. Cook County Transfer Tax. There is a rebate available 67 to Village residents that sell a home in Niles and buy another in Niles within 12 months.

Source: jocogov.org

Source: jocogov.org

The rate is 50 cents for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. How Property Taxes in Illinois Work. TheState of Illinois the County and the local municipality ie. Transfer Taxes stamps State of Illinois Transfer Tax. 1 title to real estate located in Illinois.

Source: pinterest.com

Source: pinterest.com

View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4. If the property transferred remains subject to an existing mortgage only the owners equity not the amount of the mortgage outstanding is included in the base for computing the tax. In our calculator we take your home value and multiply that by your countys effective property tax rate. How Property Taxes in Illinois Work. MyDec allows you to electronically submit.

Source: illinoislawreview.org

Source: illinoislawreview.org

A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. Denotes required field. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. In addition to the real estate transfer tax imposed by the State of Illinois Illinois counties and certain Illinois municipalities may also impose their own real estate transfer tax.

Source: hrblock.com

Source: hrblock.com

Cook County Property Tax Rates. 2 a beneficial interest in real property located in Illinois. State real estate transfer tax are imposed at a rate of 050 per 500 of value stated in the Transfer Tax Return. In addition to the real estate transfer tax imposed by the State of Illinois Illinois counties and certain Illinois municipalities may also impose their own real estate transfer tax. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of 050 per 500 or 500 per 100000 of property value.

Source: anmtg.com

Source: anmtg.com

Transfer Taxes stamps State of Illinois Transfer Tax. The City of Chicago. City of Chicago Transfer Tax. Transfer tax rates are frequently charged per each monetary unit of sale price. Property tax assessments and collections in Illinois run on a roughly two-year cycle.

Source: cityofsycamore.com

Source: cityofsycamore.com

MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. The City of Chicago. Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. 52 Zeilen How much do real estate transfer taxes cost. Houses 1 days ago Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies.

Source: sampleforms.com

Source: sampleforms.com

Transfer Taxes stamps State of Illinois Transfer Tax. The City of Chicago. In addition counties may apply an additional tax of 025 per 500. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Or 3 a controlling interest in a real estate entity owning property in Illinois.

Source: hrblock.com

Source: hrblock.com

The median property tax on a 31690000 house is 548237 in Illinois The median property tax on a 31690000 house is 332745 in the United States Remember. 1 title to real estate located in Illinois. State of Illinois Forms PTAX-203 203-A and 203-B. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes.

Source: civicfed.org

Source: civicfed.org

Or 3 a controlling interest in a real estate entity owning property in Illinois. There is a rebate available 67 to Village residents that sell a home in Niles and buy another in Niles within 12 months. The tax is imposed on the privilege of transferring title to real estate or a beneficial interest in real property that is the subject of a land trust in Illinois as represented by documents deed or trust agreement filed for recordation. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. If the property transferred remains subject to an existing mortgage only the owners equity not the amount of the mortgage outstanding is included in the base for computing the tax.

Source: deeds.com

Source: deeds.com

The City of Chicago. Houses 1 days ago Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. Transfer tax rates are frequently charged per each monetary unit of sale price. Denotes required field. State real estate transfer tax are imposed at a rate of 050 per 500 of value stated in the Transfer Tax Return.

Source: sampleforms.com

Source: sampleforms.com

Houses 1 days ago Transfer Tax Calculator In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. State of Illinois Forms PTAX-203 203-A and 203-B. The tax is imposed on the privilege of transferring title to real estate or a beneficial interest in real property that is the subject of a land trust in Illinois as represented by documents deed or trust agreement filed for recordation. Illinois imposes a tax on the privilege of transferring the following. City of Chicago Transfer Tax.

Source: illinoislawreview.org

Source: illinoislawreview.org

In our calculator we take your home value and multiply that by your countys effective property tax rate. The state of Illinois has a transfer tax that is typically paid by sellers at a rate of 050 per 500 or 500 per 100000 of property value. Cook County Property Tax Rates. Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. Transfer tax rates are frequently charged per each monetary unit of sale price.

Source: civicfed.org

Source: civicfed.org

Transfer tax rates are frequently charged per each monetary unit of sale price. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes. If the property transferred remains subject to an existing mortgage only the owners equity not the amount of the mortgage outstanding is included in the base for computing the tax. State real estate transfer tax are imposed at a rate of 050 per 500 of value stated in the Transfer Tax Return. 1 title to real estate located in Illinois.

Source: wealthfit.com

Source: wealthfit.com

The current real estate transfer tax rate is 03 which is 3 per thousand. If the transfer document states that the transfer. If the property transferred remains subject to an existing mortgage only the owners equity not the amount of the mortgage outstanding is included in the base for computing the tax. State real estate transfer tax are imposed at a rate of 050 per 500 of value stated in the Transfer Tax Return. Transfer Tax Calculator Chicago Real Estate Lawyers Law.

Source: listwithclever.com

Source: listwithclever.com

2 a beneficial interest in real property located in Illinois. Cook County Transfer Tax. 1 title to real estate located in Illinois. In year one local assessing officials appraise real estate to determine a market value for each home in their area. Transfer Tax Calculator Chicago Real Estate Lawyers Law.

Source: pinterest.com

Source: pinterest.com

In year one local assessing officials appraise real estate to determine a market value for each home in their area. In a typical real estate transaction a transfer tax is chargedby threegovernment bodies. To calculate the transfer tax burden on the sale of real estate youll first need to know the transfer tax rate. The assessed value of property in most of Illinois is equal to 3333 one-third of the market value of the residential property though it may be different in certain counties. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4.

Source: pinterest.com

Source: pinterest.com

Transfer Tax Calculator Chicago Real Estate Lawyers Law. Welcome to the TransferExcise Tax Calculator. Transfer Taxes stamps State of Illinois Transfer Tax. Cook County Property Tax Rates. This is equal to the median property tax paid as a percentage of the median home value in your county.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title illinois real estate transfer tax calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.