Your Inheriting real estate tax implications images are ready. Inheriting real estate tax implications are a topic that is being searched for and liked by netizens now. You can Get the Inheriting real estate tax implications files here. Find and Download all royalty-free vectors.

If you’re looking for inheriting real estate tax implications pictures information related to the inheriting real estate tax implications interest, you have visit the right site. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

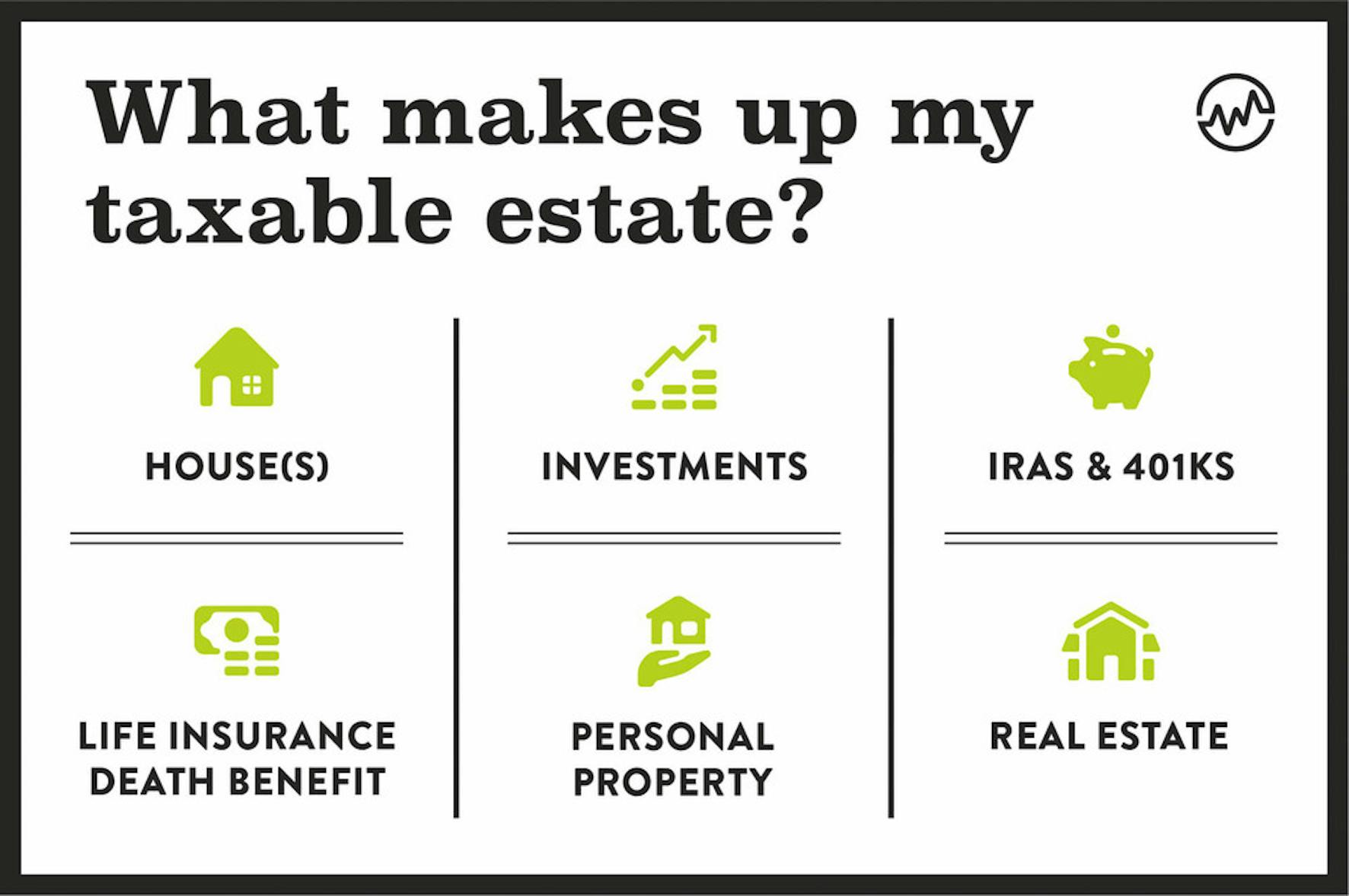

Inheriting Real Estate Tax Implications. That limit is 11180000 for the estates of people who pass away in 2018. Usually this amount is the FMV of the property right before the persons death. When the deceased acquired the property. You dont usually pay tax on anything you inherit at the time you inherit it.

How To Calculate Capital Gains On Sale Of Gifted Property Examples From relakhs.com

How To Calculate Capital Gains On Sale Of Gifted Property Examples From relakhs.com

The short answer is that if you are a US person US Citizen or Resident Alien and you are receiving inheritance from a non US person Non Resident Alien who is abroad and the assets are based outside the US non-US-Situs the US will not impose taxes on. The fair market value FMV of the property on the date of the decedents death whether or not the executor of the estate files an estate tax return. Estates pay inheritance tax. You simply get given a cost base equal to the market value of the property at the date of death. The tax implication of inheriting foreign real estate differs depending on whether or not you decide to keep this type of property. For example property that you inherit because your spouse or common law partner died or farm property or a woodlot transferred on death to a child may be treated differently.

Its paid by the estate and not the heirs although it could reduce the value of the inheritance.

When a property is inherited the IRS establishes a fair market value FMV which is the new basis for the. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. You may need to pay. 2 And finally an estate tax is a tax on the value of the decedents property. If the property was an investment property and bought before 19 September 1985 then there are no tax consequences. Estates pay inheritance tax.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

Filing an estate tax return and paying an estate tax is only required if the computed value of the property is above a specified limit. The basis of property inherited from a decedent is generally one of the following. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. When selling secondary residences capital gains are taxable. For example property that you inherit because your spouse or common law partner died or farm property or a woodlot transferred on death to a child may be treated differently.

Source: sbnri.com

Source: sbnri.com

An inheritance tax is a tax on the property you receive from the decedent. When the deceased acquired the property. Person receives an inheritance from overseas there is the immediate concern of whether it is taxable. Instead an estate tax must be paid from the estate before it is distributed to heirs. When a person dies his assets are managed by an executor who in accordance with his preferences as laid out in the will pays any debts pays taxes and disburses.

Source: regions.com

Source: regions.com

Filing an estate tax return and paying an estate tax is only required if the computed value of the property is above a specified limit. Instead an estate tax must be paid from the estate before it is distributed to heirs. 2 And finally an estate tax is a tax on the value of the decedents property. The act of inheriting a property doesnt trigger any automatic tax liability but what you decide to do with the house move in rent it or sell it will cause you to incur property taxes capital gains taxes or other expenses more on that below. When the deceased acquired the property.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

However there are exceptions to this rule. You simply get given a cost base equal to the market value of the property at the date of death. Estates pay inheritance tax. Income Tax on profit you later earn from your inheritance eg dividends from shares or rental. Its paid by the estate and not the heirs although it could reduce the value of the inheritance.

Source: relakhs.com

Source: relakhs.com

An inheritance tax is a tax on the property you receive from the decedent. Estates pay inheritance tax. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Generally the catalyst for US. The act of inheriting a property doesnt trigger any automatic tax liability but what you decide to do with the house move in rent it or sell it will cause you to incur property taxes capital gains taxes or other expenses more on that below.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

You simply get given a cost base equal to the market value of the property at the date of death. When selling an inherited property you are liable for the taxation of 50 of the capital gains. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. It is recommended that you request a property appraisal when you inherit the foreign real estate to confirm its value.

Source: taxfoundation.org

Source: taxfoundation.org

The difference between the 100000. If the property was an investment property and bought before 19 September 1985 then there are no tax consequences. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. In 2018 when someone dies their estate can exclude up to 56 million from federal estate taxes. The short answer is that if you are a US person US Citizen or Resident Alien and you are receiving inheritance from a non US person Non Resident Alien who is abroad and the assets are based outside the US non-US-Situs the US will not impose taxes on.

Source: notaires.fr

Source: notaires.fr

The tax implication of inheriting foreign real estate differs depending on whether or not you decide to keep this type of property. 2 And finally an estate tax is a tax on the value of the decedents property. If the property was an investment property and bought before 19 September 1985 then there are no tax consequences. The short answer is that if you are a US person US Citizen or Resident Alien and you are receiving inheritance from a non US person Non Resident Alien who is abroad and the assets are based outside the US non-US-Situs the US will not impose taxes on. You simply get given a cost base equal to the market value of the property at the date of death.

Source: taxesforexpats.com

Source: taxesforexpats.com

The difference between the 100000. The IRS does not have a tax for inherited property received from the estate of someone who is deceased. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. You simply get given a cost base equal to the market value of the property at the date of death. Generally the catalyst for US.

Source: thedailycpa.com

Source: thedailycpa.com

Person receives an inheritance from overseas there is the immediate concern of whether it is taxable. You dont usually pay tax on anything you inherit at the time you inherit it. The IRS does not have a tax for inherited property received from the estate of someone who is deceased. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. Youd have no capital gain if the decedent gave you real estate worth 350000 as of the estates valuation date and you immediately sold that property for 350000.

Source: nycasas.com

Source: nycasas.com

You dont usually pay tax on anything you inherit at the time you inherit it. When selling an inherited property you are liable for the taxation of 50 of the capital gains. It is recommended that you request a property appraisal when you inherit the foreign real estate to confirm its value. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. Youd have no capital gain if the decedent gave you real estate worth 350000 as of the estates valuation date and you immediately sold that property for 350000.

Source: housecashin.com

Source: housecashin.com

Generally the catalyst for US. The tax implications also depend on the value of the foreign real estate when you inherit it. Filing an estate tax return and paying an estate tax is only required if the computed value of the property is above a specified limit. When the deceased acquired the property. To determine if the sale of inherited property is taxable you must first determine your basis in the property.

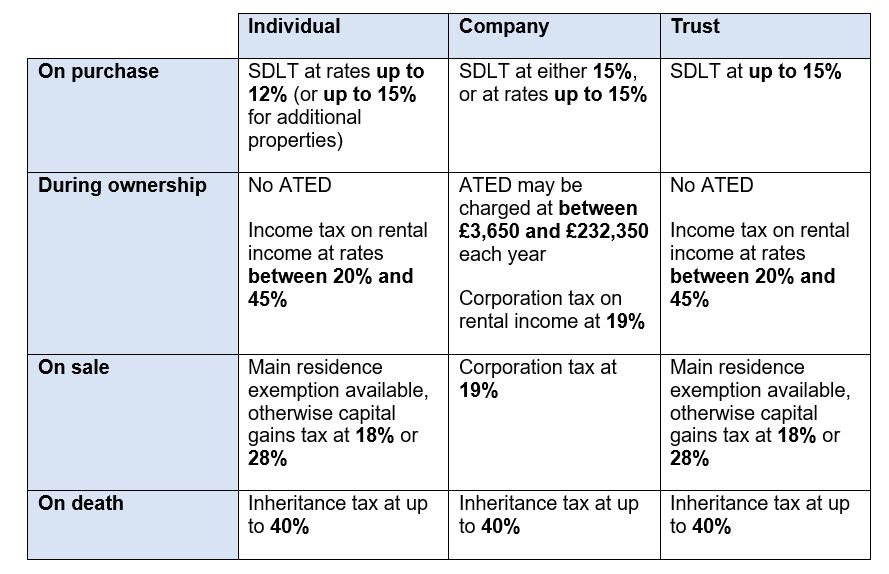

Source: farrer.co.uk

Source: farrer.co.uk

If the property was an investment property and bought before 19 September 1985 then there are no tax consequences. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. Generally the catalyst for US. 2 And finally an estate tax is a tax on the value of the decedents property. Person receives an inheritance from overseas there is the immediate concern of whether it is taxable.

Source: zillow.com

Source: zillow.com

The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. Person receives an inheritance from overseas there is the immediate concern of whether it is taxable. To determine if the sale of inherited property is taxable you must first determine your basis in the property. Also under current tax law its likely that your dads estate owes no tax on the home either. You dont usually pay tax on anything you inherit at the time you inherit it.

Source: wealthfit.com

Source: wealthfit.com

Its paid by the estate and not the heirs although it could reduce the value of the inheritance. Usually this amount is the FMV of the property right before the persons death. Tax On Inheritance from Overseas. You simply get given a cost base equal to the market value of the property at the date of death. Youd have no capital gain if the decedent gave you real estate worth 350000 as of the estates valuation date and you immediately sold that property for 350000.

Source: moneytalksnews.com

Source: moneytalksnews.com

Youd have no capital gain if the decedent gave you real estate worth 350000 as of the estates valuation date and you immediately sold that property for 350000. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. Also under current tax law its likely that your dads estate owes no tax on the home either. The fair market value FMV of the property on the date of the decedents death whether or not the executor of the estate files an estate tax return. Youd have no capital gain if the decedent gave you real estate worth 350000 as of the estates valuation date and you immediately sold that property for 350000.

Source: highgateproperties.ca

Source: highgateproperties.ca

The fair market value FMV of the property on the date of the decedents death whether or not the executor of the estate files an estate tax return. Instead an estate tax must be paid from the estate before it is distributed to heirs. Tax is not whether the property is overseas but rather whether the person. In 2018 when someone dies their estate can exclude up to 56 million from federal estate taxes. Generally the catalyst for US.

Source: integrated-realty.net

Source: integrated-realty.net

The tax implication of inheriting foreign real estate differs depending on whether or not you decide to keep this type of property. The tax implication of inheriting foreign real estate differs depending on whether or not you decide to keep this type of property. However there are exceptions to this rule. When you eventually sell it you need to pay CGT. When a property is inherited the IRS establishes a fair market value FMV which is the new basis for the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title inheriting real estate tax implications by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.