Your Jefferson county mo real estate taxes paid images are ready in this website. Jefferson county mo real estate taxes paid are a topic that is being searched for and liked by netizens now. You can Download the Jefferson county mo real estate taxes paid files here. Find and Download all free vectors.

If you’re searching for jefferson county mo real estate taxes paid pictures information related to the jefferson county mo real estate taxes paid keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Jefferson County Mo Real Estate Taxes Paid. If paying from a bank account no additional fees will apply if paying with a debit or credit card vendor andor credit card fees will be applicable. 6 days ago. Visa Debit Card - 395. Jefferson County Property Tax Inquiry.

Elgin Lancaster County Sc Real Estate Elgin Homes For Sale Realtor Com From realtor.com

Elgin Lancaster County Sc Real Estate Elgin Homes For Sale Realtor Com From realtor.com

Jefferson County Property Tax Inquiry. Currently the assessment ratios applicable for real estate property in Jefferson County are. The Jefferson County Collector of Revenue is responsible for collecting current and delinquent Personal Property Real Estate taxes. State statutes require a penalty to be added to your personal property tax bill if. Missouri Real Estate Property Tax. Personal property is assessed valued each year by the Assessors Office.

Boyer is a Missouri State Licensed Real Estate Appraiser President of the Central East Missouri Assessors Association and Education Coordinator for the Missouri State Assessors Association.

The office does not accept credit cards. Real Estate Search Personal Property Search. Newest Price high to low Price low to high Bedrooms Bathrooms. These funds are then distributed to the various entities and political subdivisions within the county which have an authorized property tax levy. Credit Card - 24 of the amount paid. Agents can add edit and manage their property listings by simply creating an account through the My Properties button.

Source: smartasset.com

Source: smartasset.com

The Jefferson County Collector of Revenue is responsible for collecting current and delinquent Personal Property Real Estate taxes. Credit Card - 24 of the amount paid. A listing of delinquent taxes is published in the Spirit of Jefferson in May and September. Your assessment list is due by March 1st of that year. Charges for online payment are as follows.

Source: stlouisrealestatenews.com

Source: stlouisrealestatenews.com

Jefferson County Treasurer 100 Jefferson County Pkwy Ste 2520 Golden CO 80419-2520. Jefferson County Property Tax Inquiry. Jefferson County Property Inquiry. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. 13520 State Road Tt Festus MO 63028 View this property at 13520 State Road Tt Festus MO 63028.

Source: thesmitsteam.com

Source: thesmitsteam.com

Jefferson Street Room 100A. 6 days ago. If you need an immediate receipt for license renewal do not pay online. The convenience fee amount is displayed at the top of the Payment Information page once a credit card is selected and is listed under Payment Amount. The office does not accept credit cards.

Source: smartasset.com

Source: smartasset.com

Newest Price high to low Price low to high Bedrooms Bathrooms. In 2019 the Collectors office was responsible for collecting distributing 279 million dollars in tax revenues. If you need an immediate receipt for license renewal do not pay online. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. A listing of delinquent taxes is published in the Spirit of Jefferson in May and September.

Charges for online payment are as follows. All checks should include on their face the Tax Ticket Number on which payment is being made. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. 6 days ago. Agents can add edit and manage their property listings by simply creating an account through the My Properties button.

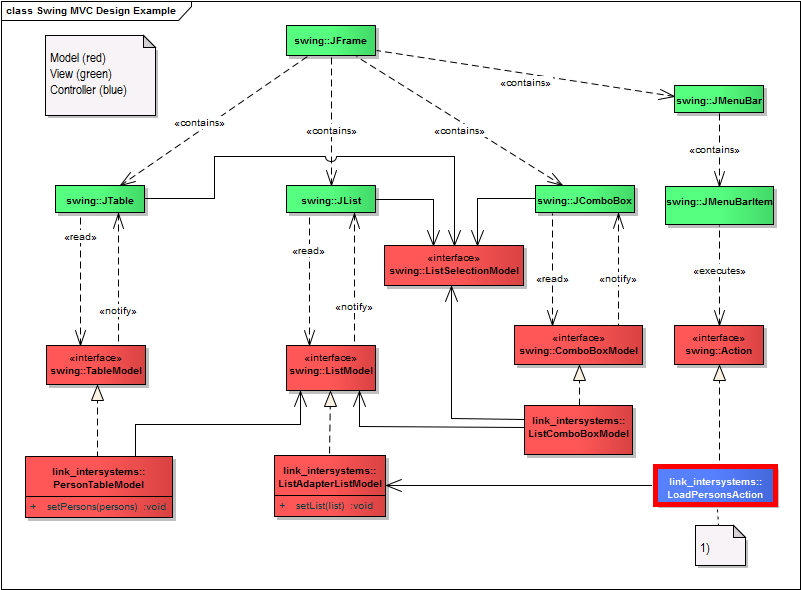

Source: study.com

Source: study.com

Your paid receipt will be mailed. Jefferson County Property Tax Inquiry. All checks should include on their face the Tax Ticket Number on which payment is being made. State statutes require a penalty to be added to your personal property tax bill if. Jefferson County MO Real Estate Homes For Sale.

Source: fasterfundslending.com

Source: fasterfundslending.com

Parcel Search Personal Property Search. The office does not accept credit cards. Non-payment of Real Estate Taxes. Personal property is assessed valued each year by the Assessors Office. State statutes require a penalty to be added to your personal property tax bill if.

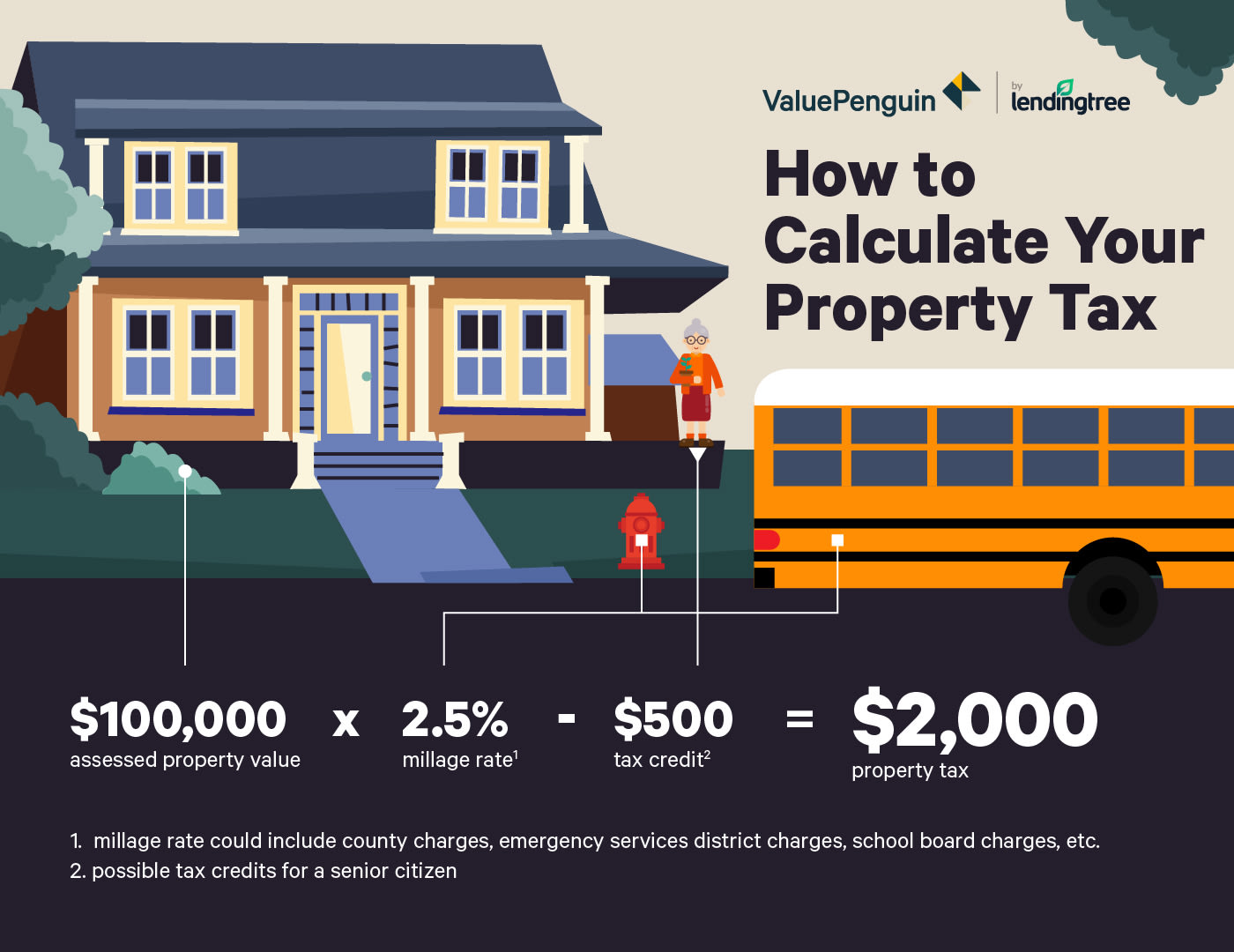

Credit Card - 24 of the amount paid. Bob Boyer was elected the first Republican Assessor of Jefferson County since 1931. Property Taxes The Property and Taxes center is the place to find the main areas for residents to find information they need from multiple Jefferson County departments divisions and elected offices on both property and what is needed for taxes. Counties in Missouri collect an average of 091 of a propertys assesed fair market value as. Online payments can be made via the Treasurer Property Records Search Application.

Source: realtor.com

Source: realtor.com

Just Now The median property tax also known as real estate tax in Jefferson County is 121900 per year based on a median home value of 15470000 and a. Pay Personal Property Real Estate Tax Online Here. All Time 45 New Post Past 24 Hours Past Week Past month. Your paid receipt will be mailed. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

Source: smartasset.com

Source: smartasset.com

If you need an immediate receipt for license renewal do not pay online. He took office on September 1st 2017 and was re-elected in November 2020. No convenience fees are assessed for payments made from checking accounts. Search for a property by clicking through the featured listings below or find something specific by using the search functionality located at the left. Boyer is a lifelong resident of Jefferson County graduating from Festus High School and Jefferson.

Source: realestateskills.com

Source: realestateskills.com

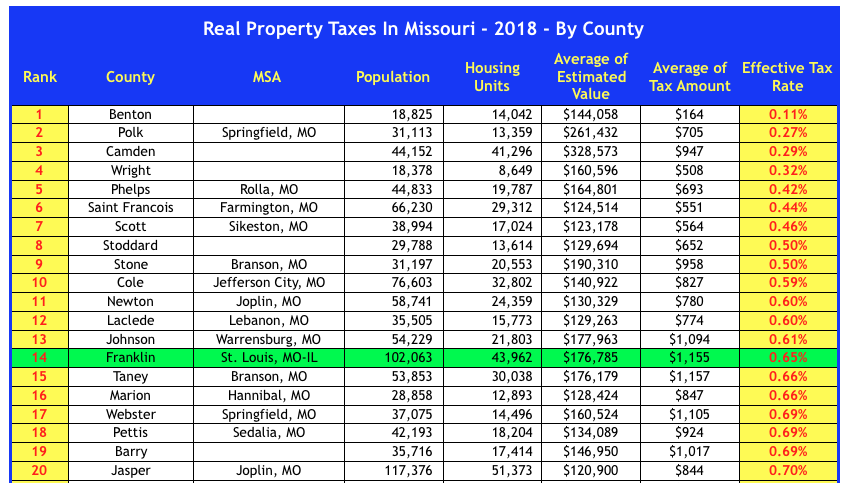

Just Now The median property tax also known as real estate tax in Jefferson County is 121900 per year based on a median home value of 15470000 and a. If paying from a bank account no additional fees will apply if paying with a debit or credit card vendor andor credit card fees will be applicable. Jefferson County Property Inquiry. Missouri Property Taxes By County. All checks should include on their face the Tax Ticket Number on which payment is being made.

Source: realtor.com

Source: realtor.com

Just Now The median property tax also known as real estate tax in Jefferson County is 121900 per year based on a median home value of 15470000 and a. 13520 State Road Tt Festus MO. In 2019 the Collectors office was responsible for collecting distributing 279 million dollars in tax revenues. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Taxes may be paid in person at any of the following locations by cash check or creditdebit cards convenience fee.

Source: zillow.com

Source: zillow.com

Personal property is assessed valued each year by the Assessors Office. State statutes require a penalty to be added to your personal property tax bill if. Bills can be paid in person with cash Visa MasterCard Discover or can be paid by mail with certified check cashiers check or money order. Personal property is assessed valued each year by the Assessors Office. If paying from a bank account no additional fees will apply if paying with a debit or credit card vendor andor credit card fees will be applicable.

Source: pinterest.com

Source: pinterest.com

The convenience fee amount is displayed at the top of the Payment Information page once a credit card is selected and is listed under Payment Amount. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Parcel Search Personal Property Search. Motorized vehicles boats recreational vehicles owned on January 1st of that year. Boyer is a Missouri State Licensed Real Estate Appraiser President of the Central East Missouri Assessors Association and Education Coordinator for the Missouri State Assessors Association.

Source: realtor.com

Source: realtor.com

He took office on September 1st 2017 and was re-elected in November 2020. Newest Price high to low Price low to high Bedrooms Bathrooms. Real Estate Locator Use the Real Estate Locator to view properties for sale in your area. Missouri Property Taxes By County. Taxes may be paid in person at any of the following locations by cash check or creditdebit cards convenience fee.

Source: realtor.com

Source: realtor.com

All checks should include on their face the Tax Ticket Number on which payment is being made. Missouri Property Taxes By County. Charges for online payment are as follows. Jefferson County Property Tax Inquiry. All checks should include on their face the Tax Ticket Number on which payment is being made.

Source: smartasset.com

Source: smartasset.com

Missouri Real Estate Property Tax. Online payments can be made via the Treasurer Property Records Search Application. Currently the assessment ratios applicable for real estate property in Jefferson County are. Jefferson County Property Tax Inquiry. Your paid receipt will be mailed.

Source: houselogic.com

Source: houselogic.com

Jefferson County MO Real Estate Homes For Sale. Pay Personal Property Real Estate Tax Online Here. 19 for residential properties 12 for agricultural properties and 32 for commercial properties. Visa Debit Card - 395. 13520 State Road Tt Festus MO 63028 View this property at 13520 State Road Tt Festus MO 63028.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title jefferson county mo real estate taxes paid by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.