Your Johnson county kansas real estate taxes images are ready. Johnson county kansas real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Johnson county kansas real estate taxes files here. Get all free images.

If you’re searching for johnson county kansas real estate taxes pictures information connected with to the johnson county kansas real estate taxes topic, you have come to the right site. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Johnson County Kansas Real Estate Taxes. 126-0586-00010 requires dashes within account number. If the taxes are paid by a mortgage company you will not receive a second half tax statement. If these taxes are not paid by May 10th interest will begin to accrue. HOA fees are common within condos and some single-family home neighborhoods.

Delivering High Quality Legal Representation For Individuals And Families Throughout Kansas If You Need Real Estat Real Estate Services Law Firm Business Law From in.pinterest.com

Delivering High Quality Legal Representation For Individuals And Families Throughout Kansas If You Need Real Estat Real Estate Services Law Firm Business Law From in.pinterest.com

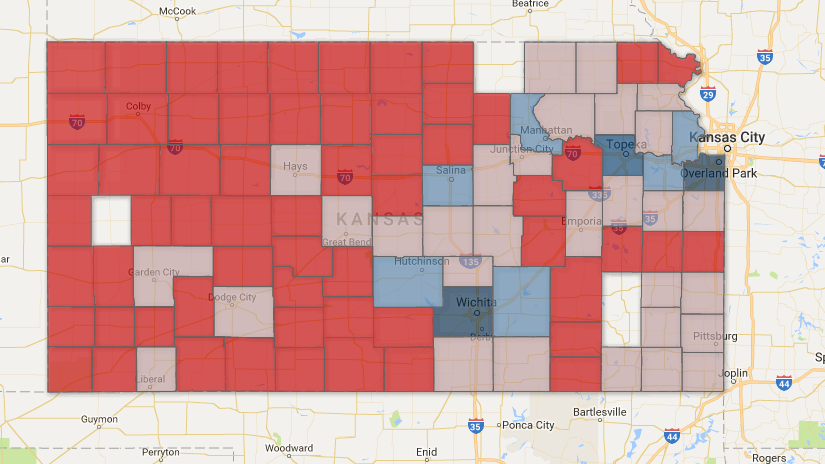

Real Estate and Personal Property Tax Johnson County Kansas Houses Just Now On delinquent taxes exceeding 10000 interest will be charged at a rate of 15 per annum for real estate and 10 per annum for personal property taxes that are delinquent. Cost sales comparison andor income. The second half real estate and personal property taxes are due on or before Monday May 11 2020. Three appraisal methods may be used. Johnson County collects the highest property tax in Kansas levying an average of 266400 127 of median home value yearly in property taxes while Osborne County has the lowest property tax in the state collecting an average tax of 59400 15 of median home value per year. Despite public outcry over a proposed 53 property tax hike to cover a 21 spending increase over two years 2019 to 2021 Johnson County Commissioners voted today to raise taxes by a revised amount of 43 by a vote of 5-2.

Commissioners Eilert Fast Hanzlick Allen and Klika voted for the property tax increase with Commissioners Brown and Ashcraft opposed.

Three appraisal methods may be used. 126-0586-00010 requires dashes within account number. Delinquent personal property tax notices are mailed in June. Date real property valuation appeals completed at informal level. Residents gave Johnson County commissioners an earful at the August 12 public hearing on the countys 2021 budget proposal which includes another property tax increase. Second half Payment Under Protest payment deadline from previous year.

Source: realtor.com

Source: realtor.com

If you do not know the account number try searching by owner name address or property location. Search by Last Name or Company Name andor Tax Year. Payments are payable to the Johnson County Treasurer. With a population of more than 585000 Johnson County is the largest county in Kansas. HOA fees are common within condos and some single-family home neighborhoods.

Source: ar.pinterest.com

Source: ar.pinterest.com

Account numbers can be found on your Johnson County Tax Statement. HOA fees are common within condos and some single-family home neighborhoods. Second half real estate tax bills mailed to property owners. Residents gave Johnson County commissioners an earful at the August 12 public hearing on the countys 2021 budget proposal which includes another property tax increase. The median property tax also known as real estate tax in Johnson County is 266400 per year based on a median home value of 20990000 and a median effective property tax rate of 127 of property value.

Source: jocogov.org

Source: jocogov.org

Deadline for filing a personal property valuation appeal. However the county actually has a relatively low average property tax rate of 124. The second half real estate and personal property taxes are due on or before Monday May 11 2020. The median property tax on a 20990000 house is 270771 in Kansas. 126-0586-00010 requires dashes within account number.

Source: pinterest.com

Source: pinterest.com

4 days ago The exact property tax levied depends on the county in Kansas the property is located in. If the taxes are paid by a mortgage company you will not receive a second half tax statement. Deadline for filing a personal property valuation appeal. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. The Johnson County Assessor values all taxable real estate in the county.

Source: pinterest.com

Source: pinterest.com

However the county actually has a relatively low average property tax rate of 124. The Johnson County Treasury and Financial Management department has begun mailing the 2019 second half real estate and personal property tax statements to Johnson County taxpayers. Date real property valuation appeals completed at informal level. However the county actually has a relatively low average property tax rate of 124. The median property tax on a 20990000 house is 270771 in Kansas.

Source: kansastreasurers.org

Source: kansastreasurers.org

If you do not know the account number try searching by owner name address or property location. Three appraisal methods may be used. If the taxes are paid by a mortgage company you will not receive a second half tax statement. If they are not paid tax warrants are issued by the 15th of July. The second half real estate and personal property taxes are due on or before Monday May 11 2020.

Source: pinterest.com

Source: pinterest.com

The median property tax also known as real estate tax in Johnson County is 266400 per year based on a median home value of 20990000 and a median effective property tax rate of 127 of property value. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. If these taxes are not paid by May 10th interest will begin to accrue. Account numbers can be found on your Johnson County Tax Statement.

Source: jocogov.org

Source: jocogov.org

If these taxes are not paid by May 10th interest will begin to accrue. These records can include Johnson County property tax assessments and assessment challenges appraisals and income taxes. Account numbers can be found on your Johnson County Tax Statement. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. Johnson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Johnson County Kansas.

Source: shawneemissionpost.com

Source: shawneemissionpost.com

The median property tax on a 20990000 house is 266573 in Johnson County. All warrants must be paid at the Johnson County Treasurers Office. Account numbers can be found on your Johnson County Tax Statement. Johnson County collects the highest property tax in Kansas levying an average of 266400 127 of median home value yearly in property taxes while Osborne County has the lowest property tax in the state collecting an average tax of 59400 15 of median home value per year. The exact property tax levied depends on the county in Kansas the property is located in.

Source: shawneemissionpost.com

Source: shawneemissionpost.com

If they are not paid tax warrants are issued by the 15th of July. Account numbers can be found on your Johnson County Tax Statement. Commissioners Eilert Fast Hanzlick Allen and Klika voted for the property tax increase with Commissioners Brown and Ashcraft opposed. Three appraisal methods may be used. The median property tax on a 20990000 house is 266573 in Johnson County.

Source: pinterest.com

Source: pinterest.com

Johnson County collects the highest property tax in Kansas levying an average of 266400 127 of median home value yearly in property taxes while Osborne County has the lowest property tax in the state collecting an average tax of 59400 15 of. Johnson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Johnson County Kansas. The median property tax on a 20990000 house is 270771 in Kansas. Search by any combination of these. Cost sales comparison andor income.

Source: it.pinterest.com

Source: it.pinterest.com

By law residential and commercial properties must be valued at between 92 and 100 percent of market value. Date real property valuation appeals completed at informal level. Real Estate and Personal Property Tax Johnson County Kansas Houses Just Now On delinquent taxes exceeding 10000 interest will be charged at a rate of 15 per annum for real estate and 10 per annum for personal property taxes that are delinquent. If you do not know the account number try searching by owner name address or property location. Account numbers can be found on your Johnson County Tax Statement.

Source: pinterest.com

Source: pinterest.com

The median real estate tax payment in Johnson County is 3018 one of the highest in the state. Deadline for filing a personal property valuation appeal. If the taxpayer paid the first half of their personal property on time the second half of the personal property taxes are due on or before May 10th. Last date for decisions from real property valuation appeal changes to be mailed. Johnson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Johnson County Kansas.

Source: bizjournals.com

Source: bizjournals.com

Last date for decisions from real property valuation appeal changes to be mailed. Residents gave Johnson County commissioners an earful at the August 12 public hearing on the countys 2021 budget proposal which includes another property tax increase. However the county actually has a relatively low average property tax rate of 124. If they are not paid tax warrants are issued by the 15th of July. The exact property tax levied depends on the county in Kansas the property is located in.

Source: pinterest.com

Source: pinterest.com

Despite public outcry over a proposed 53 property tax hike to cover a 21 spending increase over two years 2019 to 2021 Johnson County Commissioners voted today to raise taxes by a revised amount of 43 by a vote of 5-2. Search by Last Name or Company Name andor Tax Year. The Johnson County Assessor values all taxable real estate in the county. Jackson County Tax Search. Payments are payable to the Johnson County Treasurer.

Source: pinterest.com

Source: pinterest.com

Real Estate and Personal Property Tax Johnson County Kansas Houses Just Now On delinquent taxes exceeding 10000 interest will be charged at a rate of 15 per annum for real estate and 10 per annum for personal property taxes that are delinquent. The median real estate tax payment in Johnson County is 3018 one of the highest in the state. The median property tax on a 20990000 house is 266573 in Johnson County. Certain types of Tax Records are available to the general public while some Tax Records are only. The Johnson County Assessor values all taxable real estate in the county.

Source: ksrevenue.org

Source: ksrevenue.org

Johnson County collects the highest property tax in Kansas levying an average of 266400 127 of median home value yearly in property taxes while Osborne County has the lowest property tax in the state collecting an average tax of 59400 15 of median home value per year. 126-0586-00010 requires dashes within account number. Three appraisal methods may be used. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. Jackson County Tax Search.

Source: point2homes.com

Source: point2homes.com

The median property tax also known as real estate tax in Johnson County is 266400 per year based on a median home value of 20990000 and a median effective property tax rate of 127 of property value. Deadline for filing a personal property valuation appeal. The median property tax on a 20990000 house is 270771 in Kansas. Second half real estate tax bills mailed to property owners. HOA fees are common within condos and some single-family home neighborhoods.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title johnson county kansas real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.