Your Kane county real estate taxes images are available in this site. Kane county real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Kane county real estate taxes files here. Download all free vectors.

If you’re looking for kane county real estate taxes pictures information related to the kane county real estate taxes topic, you have visit the ideal blog. Our website always gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

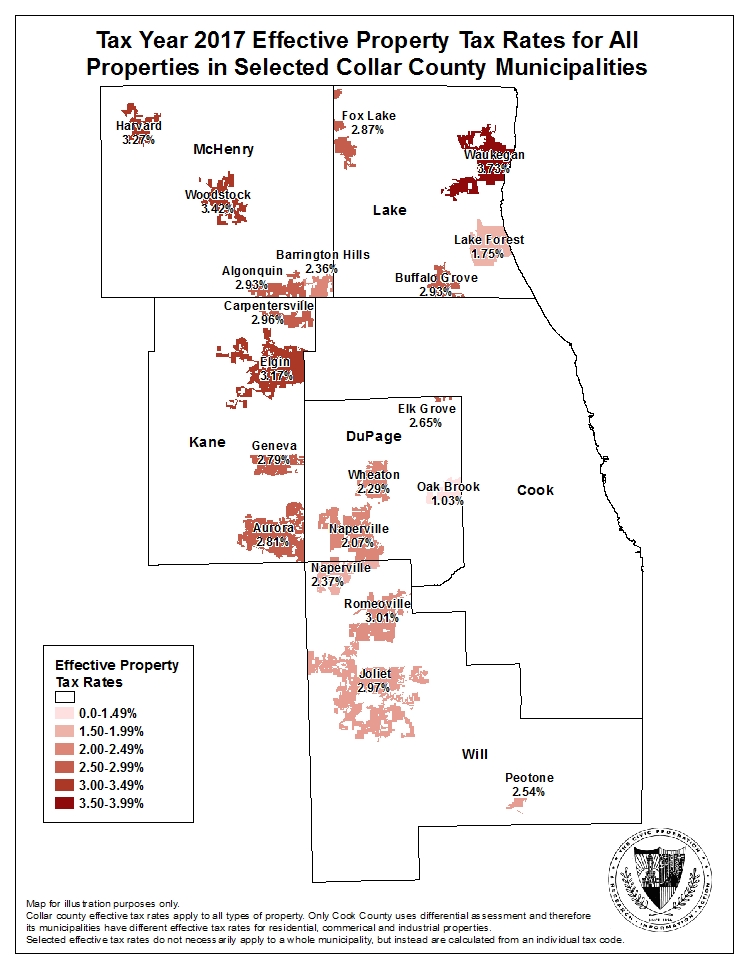

Kane County Real Estate Taxes. Appealing Your Property Taxes in Kane County Kane County residents and business owners pay some of the highest property taxes in the nation and many havent attempted to appeal their skyrocketing property tax increases due to the perceived high cost of beginning a property tax appeal in Kane County. 6302323565 RickertDavidcokaneilus Website Kane County Clerk John Cun ningham Phone. Free Kane County Property Records Search. Batavia Avenue Geneva IL.

Property Taxes Can Now Be Paid At Kane County Clerk S Aurora Branch Office Kane County Connects From kanecountyconnects.com

Property Taxes Can Now Be Paid At Kane County Clerk S Aurora Branch Office Kane County Connects From kanecountyconnects.com

You may call them at 630-232-3565 or visit their website at wwwcokaneilustreasurer. Kane County Clerk Jack Cunningham reports the Net Taxable Valuation for Kane County is 15957579053 with a total county tax extension of 1401768875. KANE COUNTY TREASURER Michael J. The bills mailed on April 30 represent 2020 real estate taxes that are payable in 2021. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

Find Kane County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records. KANE COUNTY TREASURER Michael J. Kanecountyconnects December 17 2019 Leave a comment Communities Consumers Education Events Government Homeowners Kane County Treasurers Office Taxpayers. Batavia Avenue Geneva IL. Kane County collects on average 209 of a propertys assessed fair market value as property tax. Kane County Treasurer David Rickert is reminding taxpayers that information and forms for the Senior Citizens.

Source: kanecountyconnects.com

Source: kanecountyconnects.com

Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. 6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk W. Kane County Clerk Jack Cunningham reports the Net Taxable Valuation for Kane County is 15957579053 with a total county tax extension of 1401768875. Kane County collects on average 209 of a propertys assessed fair market value as property tax. The median property tax on a 24500000 house is 512050 in Kane County.

Source: civicfed.org

Source: civicfed.org

Will County and Kane County property taxes are dune on June 1 and residents and businesses alike are concerned about their ability to pay their bills and on time. Free Kane County Property Records Search. Kane County Treasurer David J. Kane County Treasurer David Rickert is reminding taxpayers that information and forms for the Senior Citizens. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process.

Source: yorkvillelawyer.com

Source: yorkvillelawyer.com

In-depth Kane County IL Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Kane County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. When Kane County receives notice of the filing they will hold the unsold taxes on that parcel out of sale. Kane County Property Tax Inquiry. The form is available on our web site or you can call 630-553-4124 to have one sent to you.

The median property tax on a 24500000 house is 423850 in Illinois. Property taxes are paid at the Kane County Treasurers office located at 719 S. When the tax is held out of sale the tax becomes forfeited tax and can only be paid in full. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process. For instance if you owned property in the year 2016 you will be paying the real estate tax.

Source: abc7chicago.com

Source: abc7chicago.com

Enter your search criteria into at least one of the following fields. Kanecountyconnects December 17 2019 Leave a comment Communities Consumers Education Events Government Homeowners Kane County Treasurers Office Taxpayers. KANE COUNTY TREASURER Michael J. A property tax appeal enables you to reduce your real estate-related expenses without any degradation in the quality of services and amenities available to those who use the space. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

Source: laurenjacksonlaw.com

Source: laurenjacksonlaw.com

6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk W. The form is available on our web site or you can call 630-553-4124 to have one sent to you. Kane County collects on average 209 of a propertys assessed fair market value as property tax. 6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk W. You may call them at 630-232-3565 or visit their website at wwwcokaneilustreasurer.

Source: kanecountyconnects.com

Source: kanecountyconnects.com

Our County property tax appeal lawyers efficiently and effectively appeal your Kane County property taxes to help ease your tax burden. Everything you should know about your Kane County Tax Bill. The bills mailed on April 30 represent 2020 real estate taxes that are payable in 2021. You will need to complete and sign an authorization form and attach a voided check. Batavia Avenue Geneva IL.

Source: countyofkane.org

Source: countyofkane.org

KANE COUNTY TREASURER Michael J. Property Tax Appeals in Kane County. The first installment will be due on or before June 1 2021 and the second installment will be due on or before September 1 2021. Kendall County provides convenient and timely payment of your real estate taxes. Appealing Your Property Taxes in Kane County Kane County residents and business owners pay some of the highest property taxes in the nation and many havent attempted to appeal their skyrocketing property tax increases due to the perceived high cost of beginning a property tax appeal in Kane County.

Source: kanecountyreporter.com

Source: kanecountyreporter.com

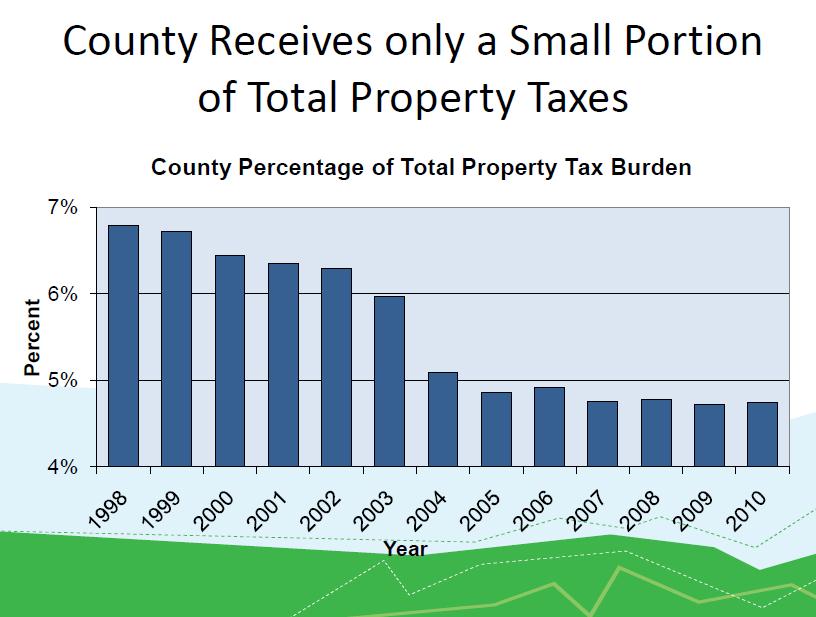

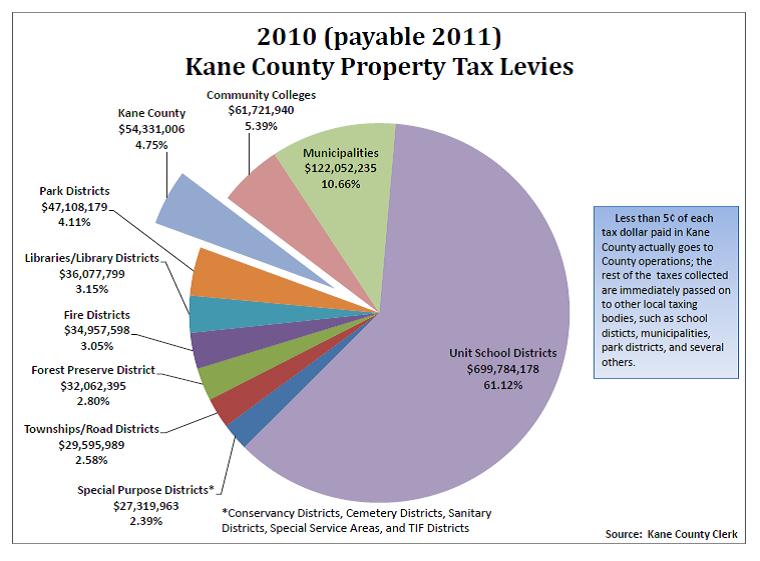

Kendall County provides convenient and timely payment of your real estate taxes. The County Collector is charged by the County Clerk to collect all of the taxes levied by approximately 270 local taxing bodies within Kane County. Kane County has one of the highest median property taxes in the United. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. Upon receipt of the collector books from the County Clerk the County Collector prepares tax bills for real estate taxes within the County and mails them to owners of record.

Source: dailyherald.com

Source: dailyherald.com

For instance if you owned property in the year 2016 you will be paying the real estate tax. Kane County Treasurer David Rickert is reminding taxpayers that information and forms for the Senior Citizens. A property tax appeal enables you to reduce your real estate-related expenses without any degradation in the quality of services and amenities available to those who use the space. Kane County has one of the highest median property taxes in the United. The median property tax on a 24500000 house is 512050 in Kane County.

Source: zillow.com

Source: zillow.com

The first installment will be due on or before June 1 2021 and the second installment will be due on or before September 1 2021. The form is available on our web site or you can call 630-553-4124 to have one sent to you. You may call them at 630-232-3565 or visit their website at wwwcokaneilustreasurer. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process. Kane County Property Tax Inquiry.

Source: kanecountyconnects.com

Source: kanecountyconnects.com

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. We save you money on your residential commercial property tax appeals in Kane County by researching fighting and reducing property tax obligations in Kane County. Kane County Treasurer David Rickert is reminding taxpayers that information and forms for the Senior Citizens. Kane County has one of the highest median property taxes in the United. Find Kane County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records.

Source: zillow.com

Source: zillow.com

When calculating property taxes the local tax assessor determines the fair market value FMV of each property within the assessors purview. Our County property tax appeal lawyers efficiently and effectively appeal your Kane County property taxes to help ease your tax burden. Find Kane County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records. Property Tax Appeals in Kane County. The median property tax on a 24500000 house is 423850 in Illinois.

Source: kanecountyconnects.com

Source: kanecountyconnects.com

Our County property tax appeal lawyers efficiently and effectively appeal your Kane County property taxes to help ease your tax burden. Everything you should know about your Kane County Tax Bill. When Kane County receives notice of the filing they will hold the unsold taxes on that parcel out of sale. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process. Find Kane County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records.

Source: kaneil.devnetwedge.com

Source: kaneil.devnetwedge.com

6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk W. Enter your search criteria into at least one of the following fields. You may call them at 630-232-3565 or visit their website at wwwcokaneilustreasurer. Free Kane County Property Records Search. Kane County collects on average 209 of a propertys assessed fair market value as property tax.

Source: abc7chicago.com

Source: abc7chicago.com

The first installment will be due on or before June 1 2021 and the second installment will be due on or before September 1 2021. The form is available on our web site or you can call 630-553-4124 to have one sent to you. For instance if you owned property in the year 2016 you will be paying the real estate tax. Our County property tax appeal lawyers efficiently and effectively appeal your Kane County property taxes to help ease your tax burden. Free Kane County Property Records Search.

Source: kanecountyconnects.com

Source: kanecountyconnects.com

Kane County Clerk Jack Cunningham reports the Net Taxable Valuation for Kane County is 15957579053 with a total county tax extension of 1401768875. Find Kane County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records. The bills mailed on April 30 represent 2020 real estate taxes that are payable in 2021. KANE COUNTY TREASURER Michael J. 209 of home value.

Source: countyofkane.org

Source: countyofkane.org

Kane County Clerk Jack Cunningham reports the Net Taxable Valuation for Kane County is 15957579053 with a total county tax extension of 1401768875. You may call them at 630-232-3565 or visit their website at wwwcokaneilustreasurer. Enter Parcel Number with or without dashes Parcel Number. 6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk W. KANE COUNTY TREASURER Michael J.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kane county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.