Your Lee county florida real estate taxes images are ready in this website. Lee county florida real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Lee county florida real estate taxes files here. Download all free vectors.

If you’re searching for lee county florida real estate taxes pictures information related to the lee county florida real estate taxes topic, you have pay a visit to the ideal site. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Lee County Florida Real Estate Taxes. Lee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lee County Florida. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. Special assessments if any are added to that. These taxes are based on an assessed value of the property.

The median property tax on a 21060000 house is 219024 in Lee County The median property tax on a 21060000 house is 204282 in Florida The median property tax on a 21060000 house is 221130 in the United States. Payment made by November 30 will receive a 4 discount. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. These taxes are based on an assessed value of the property. Lee County General Revenue 216412 x 40506 87660 Lee County Hyacinth Control 216412 x 00230 498 Lee County Library Fund 216412 x 04956 10725 Lee County. Delinquent local business tax accounts incur a 15 penalty.

Taxes must be paid in.

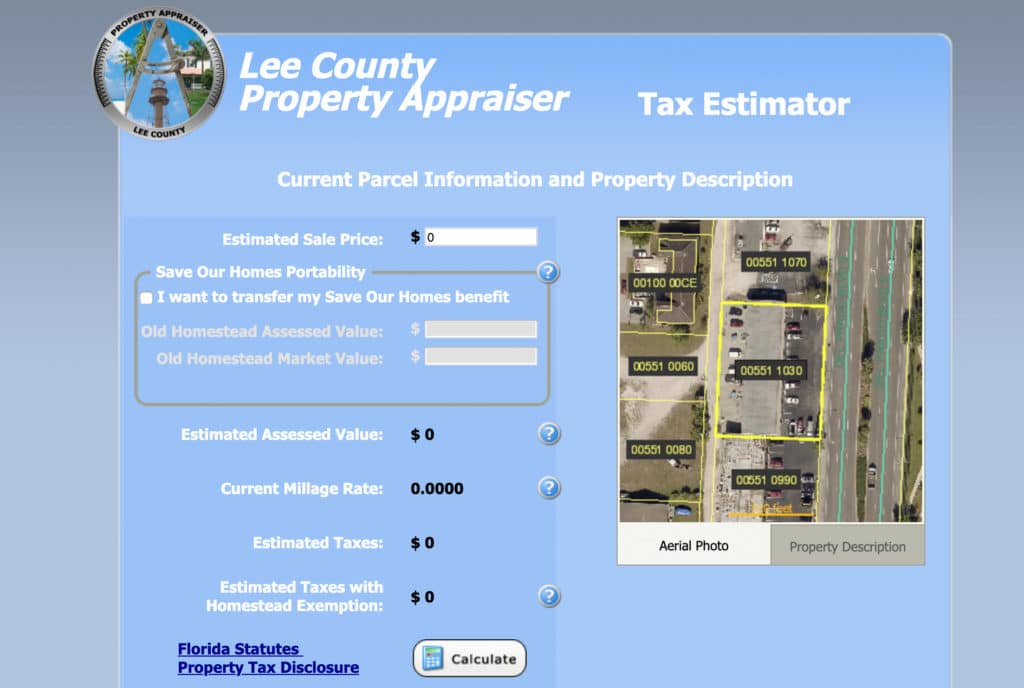

Fort Myers Florida 33901. Listed by Reitz Property Advisors 239 945-1414. Taxes must be paid in. For more information please contact the Lee County Property Appraisers office directly at 239-533- 6100 Florida property taxes are relatively unique because. Payment made by November 30 will receive a 4 discount. The Lee County Tax Assessor has an estimator that will help buyers calculate their estimated taxes.

Source: leetc.com

Source: leetc.com

Lee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lee County Florida. Office of the Lee County Tax Collector 2480 Thompson Street Fort Myers Florida 33901 Phone. 239 533-6000 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Lee County collects on average 104 of. How to submit a request to donate real property.

Source:

Source:

You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including. 239 533-6000 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. They are levied annually. Office of the Lee County Tax Collector 2480 Thompson Street Fort Myers Florida 33901 Phone. Fort Myers Florida 33901.

Listed by Reitz Property Advisors 239 945-1414. 4931 Bonita Bay Blvd 2101 Bonita Springs FL 34134 View this property at 4931 Bonita Bay Blvd 2101 Bonita Springs FL 34134. For the purposes of this Estimator we use the tax rate from the immediately previous tax year. 239 533-6000 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County.

Source: leepa.org

Source: leepa.org

For more information please contact the Lee County Property Appraisers office directly at 239-533- 6100 Florida property taxes are relatively unique because. These taxes are based on an assessed value of the property. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office – real estate property taxes and tangible personal property taxes. Florida property taxes are relatively unique because. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County.

Source: leetc.com

Source: leetc.com

Hide Contact Share Map. County Lands handles all aspects of the Countys real estate acquisition and disposition services. Below are some useful links to help answer real estate tax questions for Lee County Fl. Listed by Reitz Property Advisors 239 945-1414. The unremarried surviving spouse of a.

Source: leetc.com

Source: leetc.com

These taxes are based on an assessed value of the property. Lee County Fl Real Estate Tax Estimator. For questions about taxes or real estate in general call. How to request County real property be declared surplus by the Board of County. County Lands handles all aspects of the Countys real estate acquisition and disposition services.

Source: leetc.com

Source: leetc.com

Taxes must be paid in. For the purposes of this Estimator we use the tax rate from the immediately previous tax year. The median property tax on a 21060000 house is 219024 in Lee County The median property tax on a 21060000 house is 204282 in Florida The median property tax on a 21060000 house is 221130 in the United States. There is no such cap on rises for non-residents. Hide Contact Share Map.

Source: sanibelrealestateguide.com

Source: sanibelrealestateguide.com

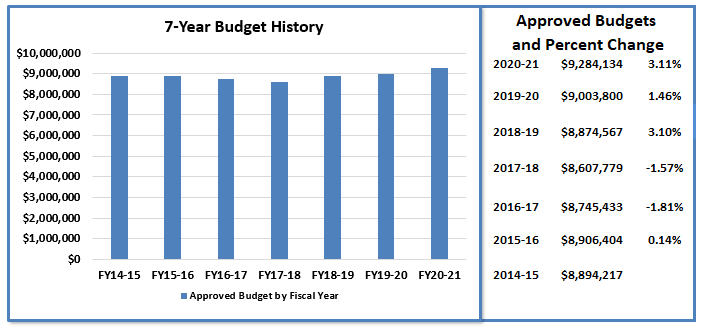

These records can include Lee County property tax assessments and assessment challenges appraisals and income taxes. Lee County collects on average 104 of. Historically tax rates have fluctuated within a fairly narrow range. Office of the Lee County Tax Collector. Florida law states that the assessed value of a property can only rise by three percent in a single year thus limiting the increases in the amount of tax paid.

Source: leepa.org

Source: leepa.org

Lee County Fl Real Estate Tax Estimator. Listed by Reitz Property Advisors 239 945-1414. The Lee county property appraiser site has a tax estimator which can you use or call us to talk. Lee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lee County Florida. Payment made by November 30 will receive a 4 discount.

The median property tax on a 21060000 house is 219024 in Lee County The median property tax on a 21060000 house is 204282 in Florida The median property tax on a 21060000 house is 221130 in the United States. Taxes have to be paid in full and at one time unless the property owner has filed for the. County Lands handles all aspects of the Countys real estate acquisition and disposition services. Fort Myers Florida 33901. These taxes are based on an assessed value of the property.

Source: leepa.org

Source: leepa.org

4931 Bonita Bay Blvd 2101 Bonita Springs FL 34134 View this property at 4931 Bonita Bay Blvd 2101 Bonita Springs FL 34134. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. These records can include Lee County property tax assessments and assessment challenges appraisals and income taxes. 239 533-6000 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Hide Contact Share Map.

Source: leetc.com

Source: leetc.com

They are levied annually. The median property tax on a 21060000 house is 219024 in Lee County The median property tax on a 21060000 house is 204282 in Florida The median property tax on a 21060000 house is 221130 in the United States. 239 533-6000 In accordance with 2017-21 Laws of Florida 119 Florida Statutes. How to request County real property be declared surplus by the Board of County. Lee County General Revenue 216412 x 40506 87660 Lee County Hyacinth Control 216412 x 00230 498 Lee County Library Fund 216412 x 04956 10725 Lee County.

Office of the Lee County Tax Collector 2480 Thompson Street Fort Myers Florida 33901 Phone. You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including. Fort Myers Florida 33901. County Lands handles all aspects of the Countys real estate acquisition and disposition services. Below are some useful links to help answer real estate tax questions for Lee County Fl.

Source: leetc.com

Source: leetc.com

Taxes have to be paid in full and at one time unless the property owner has filed for the. The median property tax in Lee County Florida is 2197 per year for a home worth the median value of 210600. Lee County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lee County Florida. The unremarried surviving spouse of a. If you do not already have a letter from the Veterans Administration stating the above you may contact the Lee County Veterans Services office located at 2440 Thompson St Fort Myers FL 239 533-8381 for assistance.

You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including. Office of the Lee County Tax Collector 2480 Thompson Street Fort Myers Florida 33901 Phone. They are levied annually. If you do not already have a letter from the Veterans Administration stating the above you may contact the Lee County Veterans Services office located at 2440 Thompson St Fort Myers FL 239 533-8381 for assistance. Collection of real estate property taxes and tangible personal property taxes begins.

Source: sheriffleefl.org

Source: sheriffleefl.org

There is no such cap on rises for non-residents. How to request County real property be declared surplus by the Board of County. Office of the Lee County Tax Collector. Florida law states that the assessed value of a property can only rise by three percent in a single year thus limiting the increases in the amount of tax paid. You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including.

Generally we find taxes to be about 2 of the taxable value and taxable value 80-90 of market value less exemptions you qualify for. Listed by Reitz Property Advisors 239 945-1414. The Lee County Tax Assessor has an estimator that will help buyers calculate their estimated taxes. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. Florida property taxes are relatively unique because.

If you do not already have a letter from the Veterans Administration stating the above you may contact the Lee County Veterans Services office located at 2440 Thompson St Fort Myers FL 239 533-8381 for assistance. County Lands handles all aspects of the Countys real estate acquisition and disposition services. Office of the Lee County Tax Collector 2480 Thompson Street Fort Myers Florida 33901 Phone. For more information please contact the Lee County Property Appraisers office directly at 239-533- 6100 Florida property taxes are relatively unique because. Historically tax rates have fluctuated within a fairly narrow range.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title lee county florida real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.