Your Loudoun county virginia real estate assessments online images are ready in this website. Loudoun county virginia real estate assessments online are a topic that is being searched for and liked by netizens now. You can Get the Loudoun county virginia real estate assessments online files here. Find and Download all royalty-free photos and vectors.

If you’re looking for loudoun county virginia real estate assessments online pictures information connected with to the loudoun county virginia real estate assessments online topic, you have visit the right blog. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Loudoun County Virginia Real Estate Assessments Online. The Board of Equalization will begin taking appeals on March 15 2021. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real. Houses 2 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998.

Loudoun County Virginia House Histories Familysearch From familysearch.org

Loudoun County Virginia House Histories Familysearch From familysearch.org

Loudoun County Commissioner of the Revenue Robert S. The Board of Equalization will begin taking appeals on March 15 2021. Has published real estate assessments for tax year 2021 online at loudoungovparceldatabase. The Loudoun County Board of Supervisors continues to meet. SE Leesburg VA 20175. What this site provides.

Houses 2 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998.

The Board of Equalization will begin taking appeals on March 15 2021. The BOE has an online appeal application system for use by the citizens of Loudoun County. Loudoun County Government PO. What this site provides. Box 7000 Leesburg VA 20177 Phone. Welcome to the Loudoun County Real Estate Information Site.

Source: pinterest.com

Source: pinterest.com

Loudoun County Government PO. What this site provides. Announces that Loudoun County real estate assessments for tax year 2021 are now available online at loudoungovparceldatabase. SE Leesburg VA 20175. This division is responsible for the annual assessment of all residential homes and commercial businesses in Loudoun County which utilizes tax.

The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real. Real Estate Assessment Data Online. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Loudoun County Government PO. SE Leesburg VA 20175.

Source: patch.com

Source: patch.com

These records can include Loudoun County property tax assessments and assessment challenges appraisals and income taxes. Box 7000 Leesburg VA 20177 Phone. The BOE has an online appeal application system for use by the citizens of Loudoun County. The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real. These records can include Loudoun County property tax assessments and assessment challenges appraisals and income taxes.

Source: loudountimes.com

Source: loudountimes.com

COVID-19 Updates Get the latest information on COVID-19 Click Here. Houses 1 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998. Houses 2 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998. Loudoun County real estate taxes are collected twice a year. The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real property.

Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of Supervisors. That value will also influence the real estate tax rate supervisors set during budget deliberations to pay for county government and projects. SE Leesburg VA 20175. This division is responsible for the annual assessment of all residential homes and commercial businesses in Loudoun County which utilizes tax. Loudoun County Commissioner of the Revenue Robert S.

Loudoun County Commissioner of the Revenue Robert S. COVID-19 Updates Get the latest information on COVID-19 Click Here. Property owners who believe their assessments are incorrect may file an Application for Review with the Commissioner of the Revenue online at loudoungovreaa by March 8 2021. Real Estate Assessment Data Online. The Board is conducting electronic meetings under the Emergency Ordinance adopted by the Board March 25 2020.

Source: loudountimes.com

Source: loudountimes.com

The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real property. The Board encourages residents to participate in the meetings remotely and to view the meetings through the Loudoun County webcast system or on television on Comcast Government Channel 23 Open Band. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Certain types of Tax Records are available to the. Houses 1 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998.

Source: nisquallycorrections.com

Source: nisquallycorrections.com

Real Estate Assessments FAQs. Houses 8 days ago The assessments let property owners know the assessed value of their property as of Jan. Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998. Box 7000 Leesburg VA 20177 Phone. The Real Estate division includes residential homes commercial businesses as well as agricultural properties.

Limitations all provided by the Loudoun County Office of Mapping on the Real Estate Assessment link of the Countys website wwwloudoungov. Printed assessment notices will be mailed to property owners this week. That value will also influence the real estate tax rate supervisors set during budget deliberations to pay for county government and projects. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. This division is responsible for the annual assessment of all residential homes and commercial businesses in Loudoun County which utilizes tax.

Source: loc.gov

Source: loc.gov

The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real property. Real estate in Virginia is assessed at 100 of its fair market value. Find Loudoun County Property Records Loudoun County Property Records are real estate documents that contain information related to real property in Loudoun County Virginia. Real Estate Taxes and Assessments. The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real.

SE Leesburg VA 20175. Loudoun County Commissioner of the Revenue Robert S. Welcome to the Loudoun County Real Estate Information Site. The Board is conducting electronic meetings under the Emergency Ordinance adopted by the Board March 25 2020. Houses 2 days ago Loudoun County is providing public record information as a public service in accordance with Virginia Code Title 581-31222 1998.

Source: wtop.com

Source: wtop.com

Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of Supervisors. Printed assessment notices will be mailed to property owners this week. Has published real estate assessments for tax year 2021 online at loudoungovparceldatabase. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Real estate in Virginia is assessed at 100 of its fair market value.

Loudoun 2021 Real Estate Assessments Available Online. The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. Loudoun County Government PO. Houses 8 days ago The assessments let property owners know the assessed value of their property as of Jan. This division is responsible for the annual assessment of all residential homes and commercial businesses in Loudoun County which utilizes tax.

The Department of Real Estate Assessments is responsible for maintaining accurate and up-to-date records on each locally assessed property in Chesterfield County. That value will also influence the real estate tax rate supervisors set during budget deliberations to pay for county government and projects. Limitations all provided by the Loudoun County Office of Mapping on the Real Estate Assessment link of the Countys website wwwloudoungov. Real estate taxes are based on real property assessments and the real property tax rate which is set annually by the Board of Supervisors. The Board encourages residents to participate in the meetings remotely and to view the meetings through the Loudoun County webcast system or on television on Comcast Government Channel 23 Open Band.

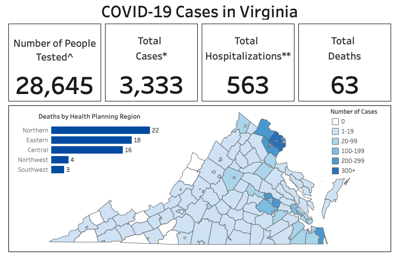

COVID-19 Updates Get the latest information on COVID-19 Click Here. Find Loudoun County Property Records Loudoun County Property Records are real estate documents that contain information related to real property in Loudoun County Virginia. Loudoun County Commissioner of the Revenue Robert S. The due dates are June 5 and December 5. These records can include Loudoun County property tax assessments and assessment challenges appraisals and income taxes.

Source: familysearch.org

Source: familysearch.org

The Loudoun County Office of the Commissioner of the Revenue provides annual valuations and maintenance of fair market values for equitable assessments on all types of real property. The value of taxable real estate in Loudoun is nearing a hundred billion dollars as Loudoun County Commissioner of the Revenue Robert S. COVID-19 Updates Get the latest information on COVID-19 Click Here. Loudoun 2021 Real Estate Assessments Available Online. Loudoun County Government PO.

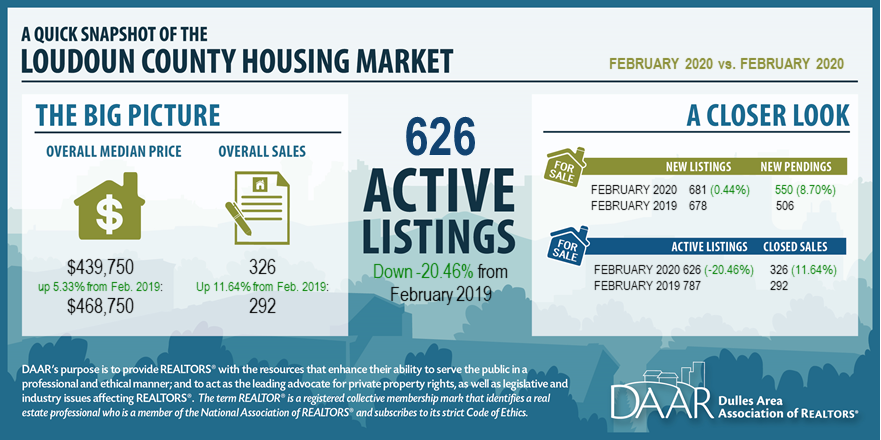

Source: dullesarea.com

Source: dullesarea.com

Real estate in Virginia is assessed at 100 of its fair market value. Loudoun County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Loudoun County Virginia. That value will also influence the real estate tax rate supervisors set during budget deliberations to pay for county government and projects. Box 7000 Leesburg VA 20177 Phone. The Real Estate division includes residential homes commercial businesses as well as agricultural properties.

Source: loudountimes.com

Source: loudountimes.com

Real estate in Virginia is assessed at 100 of its fair market value. SE Leesburg VA 20175. Loudoun 2021 Real Estate Assessments Available Online. Printed assessment notices will be mailed to property owners this week. Find Loudoun County Property Records Loudoun County Property Records are real estate documents that contain information related to real property in Loudoun County Virginia.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title loudoun county virginia real estate assessments online by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.