Your Maryland capital gains tax rate on real estate images are ready in this website. Maryland capital gains tax rate on real estate are a topic that is being searched for and liked by netizens now. You can Get the Maryland capital gains tax rate on real estate files here. Download all royalty-free vectors.

If you’re searching for maryland capital gains tax rate on real estate images information linked to the maryland capital gains tax rate on real estate interest, you have visit the right blog. Our website frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Maryland Capital Gains Tax Rate On Real Estate. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. The changeincreasing the top capital-gains rate to 434 from 238 and taxing assets as if sold when someone dieswould upend the tax strategies of. Personal Income Tax for Residents.

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin From propertycashin.com

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2021 Propertycashin From propertycashin.com

This is also a sneaky way of saying you can only sell a home once. The changeincreasing the top capital-gains rate to 434 from 238 and taxing assets as if sold when someone dieswould upend the tax strategies of. Tax Rates Exemptions Deductions. However note that these tax rates only apply if youve owned your property for more than one year. Requires only 7 inputs into a simple Excel spreadsheet. Maryland State Local Real Estate Taxes.

Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20.

The state transfer tax in Maryland is 05 of the sale price. There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. If youre selling the property in under one year then youll be subject. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. State Capital Gains Taxes.

Source: propertycashin.com

Source: propertycashin.com

Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025 says Michael Underhill chief investment officer of. Which rate your capital. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Requires only 7 inputs into a simple Excel spreadsheet. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20.

Source: propertycashin.com

Source: propertycashin.com

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. State Capital Gains Taxes. Tax Rates Exemptions Deductions. Theyre taxed at lower rates than short-term capital gains. Additional State Capital Gains Tax Information for Maryland The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Source: hrblock.com

Source: hrblock.com

State Capital Gains Taxes. Minnesota Income Tax Rates and Brackets. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. Additional State Capital Gains Tax Information for Maryland The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Source: realtor.com

Source: realtor.com

This makes this state one of the top 10 most expensive for. Maryland Income Tax Rates and Brackets. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. If it is an investment property you will have to follow the normal capital gains rules. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale.

Source: propertycashin.com

Source: propertycashin.com

Long-term capital gains are gains on assets you hold for more than one year. Currently the tax rate is 15. This makes this state one of the top 10 most expensive for. Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025 says Michael Underhill chief investment officer of. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates.

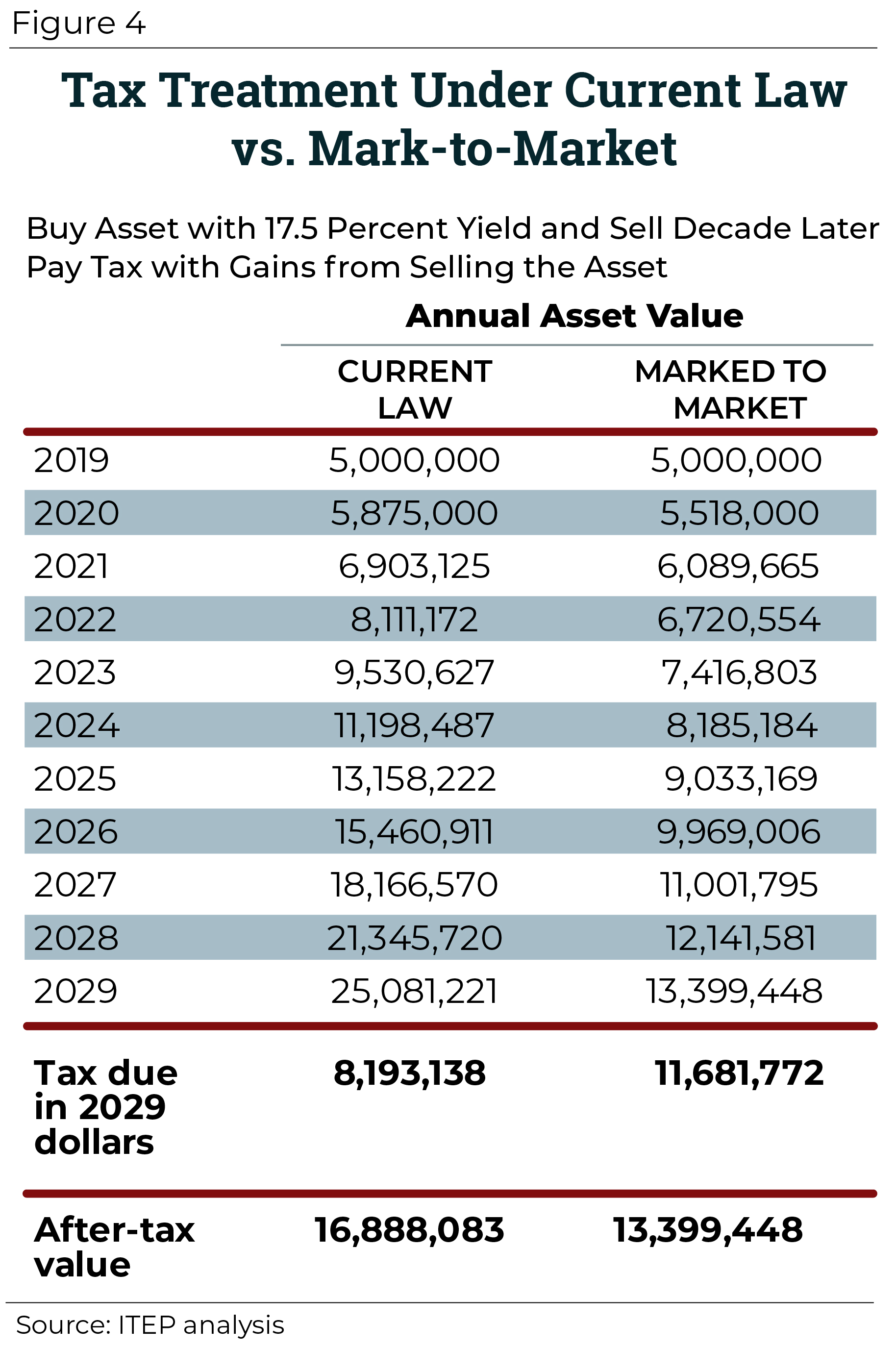

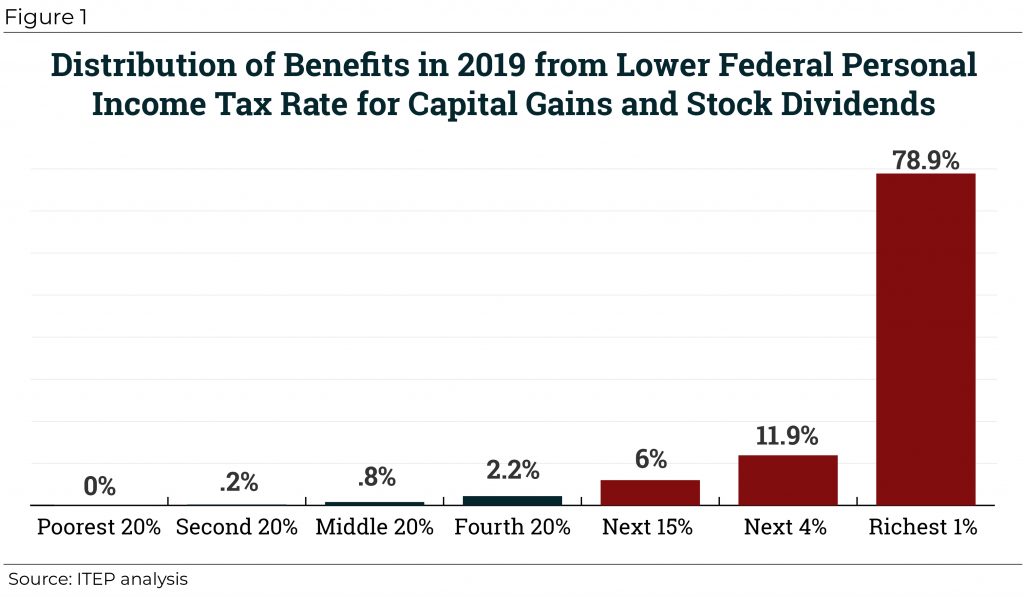

Source: itep.org

Source: itep.org

This is also a sneaky way of saying you can only sell a home once. 52 Zeilen Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. You have to live in the residence for two of five years before selling it.

Source: investopedia.com

Source: investopedia.com

Maryland Income Tax Rates and Brackets. There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Every state and even county and city can have their own unique taxes tax rates and rules. This law went into effect on October 1 2003.

Source: taxesforexpats.com

Source: taxesforexpats.com

Maryland Income Tax Rates and Brackets. The property has to be your principal residence you live in it. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings. Requires only 7 inputs into a simple Excel spreadsheet. Capital Gains Tax on Sale of Property.

Source: itep.org

Source: itep.org

Long-term capital gains are gains on assets you hold for more than one year. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. You have to live in the residence for two of five years before selling it. The changeincreasing the top capital-gains rate to 434 from 238 and taxing assets as if sold when someone dieswould upend the tax strategies of.

Source: in.pinterest.com

Source: in.pinterest.com

Maryland is no exception to this. This law went into effect on October 1 2003. You have lived in the home as your principal residence for two out of the last five years. Which rate your capital. Tax Rates Exemptions Deductions.

Source: moneycrashers.com

Source: moneycrashers.com

The property has to be your principal residence you live in it. Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025 says Michael Underhill chief investment officer of. However note that these tax rates only apply if youve owned your property for more than one year. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20.

Source: taxfoundation.org

Source: taxfoundation.org

The changeincreasing the top capital-gains rate to 434 from 238 and taxing assets as if sold when someone dieswould upend the tax strategies of. State of Maine - Individual Income Tax 2019 Rates. Real estate transfer taxes can be charged at the state city andor county levels depending on where you live. This makes this state one of the top 10 most expensive for. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Source: propertycashin.com

Source: propertycashin.com

If it is an investment property you will have to follow the normal capital gains rules. Additional State Capital Gains Tax Information for Maryland The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Rental property owners will benefit from lower ordinary income tax rates and other favorable changes to the tax brackets for 2018 through 2025 says Michael Underhill chief investment officer of. Maryland State Local Real Estate Taxes. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000.

Source: investopedia.com

Source: investopedia.com

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Requires only 7 inputs into a simple Excel spreadsheet. Benzinga reports that this pushes the true capital gains tax for property sellers in this state to over 30. Thats why some very rich Americans dont pay as much in taxes. Every state and even county and city can have their own unique taxes tax rates and rules.

Source: doughroller.net

Source: doughroller.net

There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. This law went into effect on October 1 2003. This is also a sneaky way of saying you can only sell a home once. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Benzinga reports that this pushes the true capital gains tax for property sellers in this state to over 30.

Source: hackyourwealth.com

Source: hackyourwealth.com

The property has to be your principal residence you live in it. Minnesota Income Tax Rates and Brackets. This law went into effect on October 1 2003. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

Source: itep.org

Source: itep.org

What are the current tax rate and exemption amounts. There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. What are the current tax rate and exemption amounts. 52 Zeilen Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. The property has to be your principal residence you live in it.

Source: pinterest.com

Source: pinterest.com

There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form. This law went into effect on October 1 2003. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital gains tax. Minnesota Income Tax Rates and Brackets.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title maryland capital gains tax rate on real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.