Your Mchenry county real estate taxes images are ready in this website. Mchenry county real estate taxes are a topic that is being searched for and liked by netizens today. You can Get the Mchenry county real estate taxes files here. Download all free photos.

If you’re searching for mchenry county real estate taxes images information linked to the mchenry county real estate taxes topic, you have visit the right blog. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Mchenry County Real Estate Taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Illinois Tax Law Lawyer. A committee of the McHenry County. You are now able to pay property taxes online with a credit or debit card as well as in the Treasurers office for a fee fee is collected by credit card company.

713 Christine Dr Mchenry Il 60051 Realtor Com From realtor.com

713 Christine Dr Mchenry Il 60051 Realtor Com From realtor.com

The Treasurers office is no longer collecting taxes for the 2019 tax year payable in 2020Please contact the County Clerk for payment amounts and requirements. McHenry County 121032 x 07868 95227 Johnsburg Library 121032 x 01638 19831 McHenry CO Consv 121032 x 02286 27668 School Dist 12 121032 x 58245 704954 121032 x. Once we have your property information and 50 application fee we begin to compile all relevant evidence in order to substantiate the largest possible reduction. Andrew works diligently to ensure the people he helps get the best possible results. Simply fill in the. You can begin the tax appeal process by calling our office at 815-459-8800.

Property Tax Bills Set for May 7 Mailing.

Their number is 815-334-4242. The weighted average of grade school teachers in the three districts is 60505. Your search for Mchenry County IL property taxes is now as easy as typing an address into a search bar. McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Andrew works diligently to ensure the people he helps get the best possible results.

Source:

Source:

McHenry County Assessors Website Report Link httpswwwmchenrycountyilgovcounty-governmentdepartments-a-iassessments Visit the McHenry County Assessors website for contact information office hours tax payments and bills parcel and. District Rates by Tax Code. You are now able to pay property taxes online with a credit or debit card as well as in the Treasurers office for a fee fee is collected by credit card company. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. McHenry Real Estate Services LLC 7806 NW Rosewood Circle Parkville MO 64152-6050.

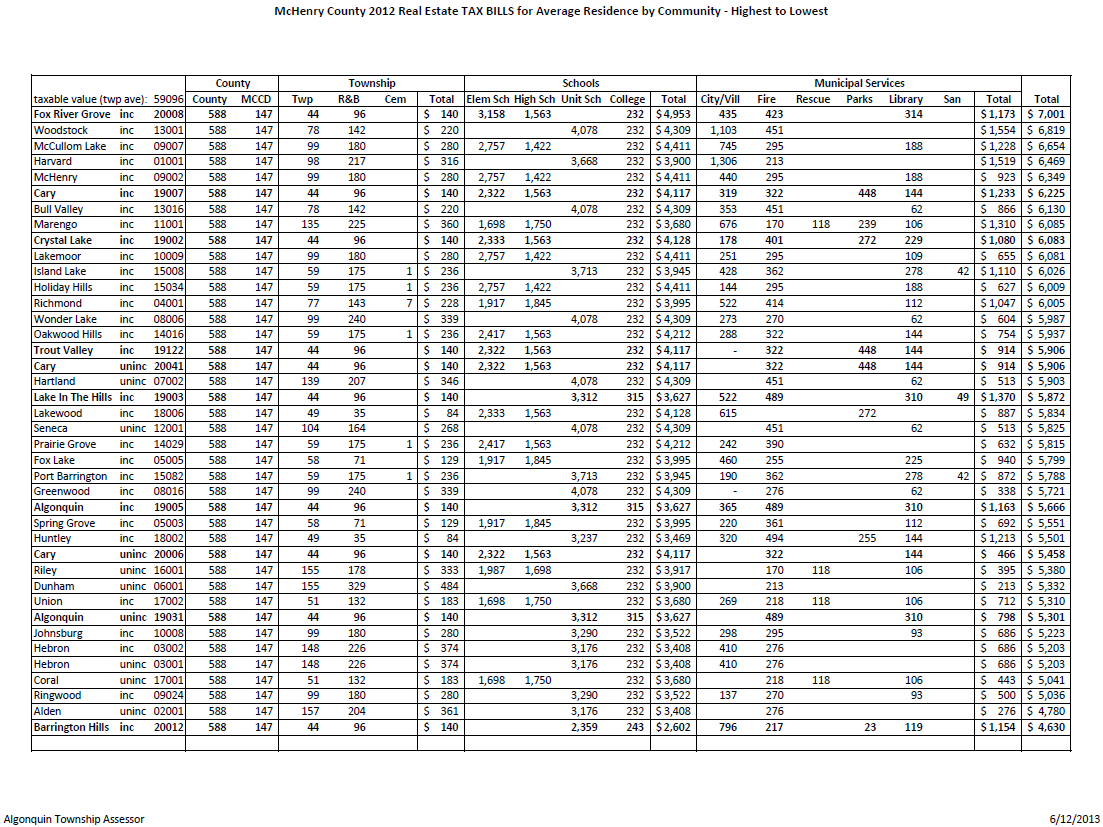

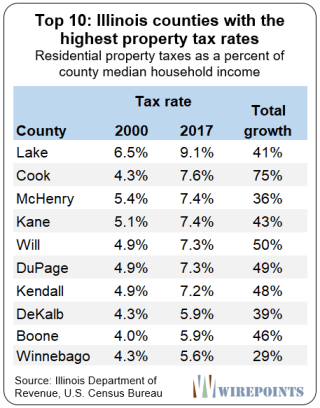

McHenry County collects on average 209 of a propertys assessed fair market value as property tax. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. District Rates by Tax Code. McHenry County has one of the highest median property taxes in the United States and is ranked 31st of the 3143 counties in order of median property taxes. Lets do some multiplication.

Source: zillow.com

Source: zillow.com

McHenry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in McHenry County Illinois. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Mchenry County IL Property Tax Search by Address Want to see what the taxes are for a certain property. The Treasurers office is no longer collecting taxes for the 2019 tax year payable in 2020Please contact the County Clerk for payment amounts and requirements. Democrats in Washington have passed legislation that allocates over 59 million to McHenry County government.

Source: realtor.com

Source: realtor.com

District Rates by Tax Code. Prior Year Adjustment 2018. For more information please call 815 334-4242 or email. McHenry Real Estate Services LLC 7806 NW Rosewood Circle Parkville MO 64152-6050. District Value Within Tax Code.

Source: realtor.com

Source: realtor.com

You can begin the tax appeal process by calling our office at 815-459-8800. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Prior Year Adjustment 2018. McHenry County pays more in property taxes on a per capita basis than 999 of all Americans Englund said she believes the value of her house was improperly assessed during the 2019. You are now able to pay property taxes online with a credit or debit card as well as in the Treasurers office for a fee fee is collected by credit card company.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

McHenry County pays more in property taxes on a per capita basis than 999 of all Americans Englund said she believes the value of her house was improperly assessed during the 2019. The Treasurers office is no longer collecting taxes for the 2019 tax year payable in 2020Please contact the County Clerk for payment amounts and requirements. Property Tax Bills Set for May 7 Mailing. The McHenry County Clerks office has a variety of property tax responsibilities. McHenry County Assessors Website Report Link httpswwwmchenrycountyilgovcounty-governmentdepartments-a-iassessments Visit the McHenry County Assessors website for contact information office hours tax payments and bills parcel and.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

The weighted average of grade school teachers in the three districts is 60505. District Value Within Tax Code. You are now able to pay property taxes online with a credit or debit card as well as in the Treasurers office for a fee fee is collected by credit card company. McHenry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in McHenry County Illinois. McHenry County pays more in property taxes on a per capita basis than 999 of all Americans Englund said she believes the value of her house was improperly assessed during the 2019.

Source: realtor.com

Source: realtor.com

McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes. Real Estate Tax Bills in the Mail May 7th Posted on 04282021 by Cal Skinner April 28 2021 From McHenry County Treasurer Glenda Miller. Illinois Tax Law Lawyer. Federal Tooth Fairy Bringing McHenry County 5969087203 If Used to Cut Real Estate Taxes Bills Could Decrease 88 Posted on 03112021 by Cal Skinner McHenry County has a budget of about 208 million. McHenry County Assessors Website Report Link httpswwwmchenrycountyilgovcounty-governmentdepartments-a-iassessments Visit the McHenry County Assessors website for contact information office hours tax payments and bills parcel and.

Source: realtor.com

Source: realtor.com

The median property tax also known as real estate tax in McHenry County is 522600 per year based on a median home value of 24970000 and a median. Democrats in Washington have passed legislation that allocates over 59 million to McHenry County government. McHenry County 121032 x 07868 95227 Johnsburg Library 121032 x 01638 19831 McHenry CO Consv 121032 x 02286 27668 School Dist 12 121032 x 58245 704954 121032 x. Federal Tooth Fairy Bringing McHenry County 5969087203 If Used to Cut Real Estate Taxes Bills Could Decrease 88 Posted on 03112021 by Cal Skinner McHenry County has a budget of about 208 million. You are now able to pay property taxes online with a credit or debit card as well as in the Treasurers office for a fee fee is collected by credit card company.

Source: dailyherald.com

Source: dailyherald.com

For more information please call 815 334-4242 or email. The weighted average of grade school teachers in the three districts is 60505. Gordon is the founder and managing attorney of Gordon Law Group an aggressive tax business law firm in Chicago. Property Tax Bills Set for May 7 Mailing. Once we have your property information and 50 application fee we begin to compile all relevant evidence in order to substantiate the largest possible reduction.

Source: primelawgroup.com

Source: primelawgroup.com

The median property tax also known as real estate tax in McHenry County is 522600 per year based on a median home value of 24970000 and a median. Your search for Mchenry County IL property taxes is now as easy as typing an address into a search bar. McHenry County collects on average 209 of a propertys assessed fair market value as property tax. McHenry County 121032 x 07868 95227 Johnsburg Library 121032 x 01638 19831 McHenry CO Consv 121032 x 02286 27668 School Dist 12 121032 x 58245 704954 121032 x. McHenry County Assessors Website Report Link httpswwwmchenrycountyilgovcounty-governmentdepartments-a-iassessments Visit the McHenry County Assessors website for contact information office hours tax payments and bills parcel and.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

The treasurers office provides easy acces to tax and real estate records throughout the year to anyone who requests that information. Once we have your property information and 50 application fee we begin to compile all relevant evidence in order to substantiate the largest possible reduction. McHenry County Assessors Website Report Link httpswwwmchenrycountyilgovcounty-governmentdepartments-a-iassessments Visit the McHenry County Assessors website for contact information office hours tax payments and bills parcel and. The McHenry County Clerks office has a variety of property tax responsibilities. Simply fill in the.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

Gordon is the founder and managing attorney of Gordon Law Group an aggressive tax business law firm in Chicago. These records can include McHenry County property tax assessments and assessment challenges appraisals and income taxes. The median property tax also known as real estate tax in McHenry County is 522600 per year based on a median home value of 24970000 and a median. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes.

Source: realtor.com

Source: realtor.com

The difference between the average weighted elementary school salary and the District 155 High School teachers average salary of 91573 is 31066. Illinois Tax Law Lawyer. McHenry County pays more in property taxes on a per capita basis than 999 of all Americans Englund said she believes the value of her house was improperly assessed during the 2019. The treasurers office provides easy acces to tax and real estate records throughout the year to anyone who requests that information. The weighted average of grade school teachers in the three districts is 60505.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

McHenry County pays more in property taxes on a per capita basis than 999 of all Americans Englund said she believes the value of her house was improperly assessed during the 2019. Any No HOA Fee 50month100month200month300. Illinois Tax Law Lawyer. McHenry County has one of the highest median property taxes in the United States and is ranked 31st of the 3143 counties in order of median property taxes. McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

Andrew works diligently to ensure the people he helps get the best possible results. Any No HOA Fee 50month100month200month300. McHenry County collects on average 209 of a propertys assessed fair market value as property tax. The treasurers office provides easy acces to tax and real estate records throughout the year to anyone who requests that information. McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

Any No HOA Fee 50month100month200month300. McHenry County 121032 x 07868 95227 Johnsburg Library 121032 x 01638 19831 McHenry CO Consv 121032 x 02286 27668 School Dist 12 121032 x 58245 704954 121032 x. Illinois Tax Law Lawyer. Any No HOA Fee 50month100month200month300. McHenry County residents may not have to pay late fees and penalties if they need more time to pay the second installment of this years property taxes.

Source: mchenrycountyblog.com

Source: mchenrycountyblog.com

McHenry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in McHenry County Illinois. Any No HOA Fee 50month100month200month300. The weighted average of grade school teachers in the three districts is 60505. McHenry Real Estate Services LLC 7806 NW Rosewood Circle Parkville MO 64152-6050. McHenry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in McHenry County Illinois.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title mchenry county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.