Your Medina county real estate taxes images are ready. Medina county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Medina county real estate taxes files here. Download all royalty-free photos and vectors.

If you’re looking for medina county real estate taxes images information related to the medina county real estate taxes keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

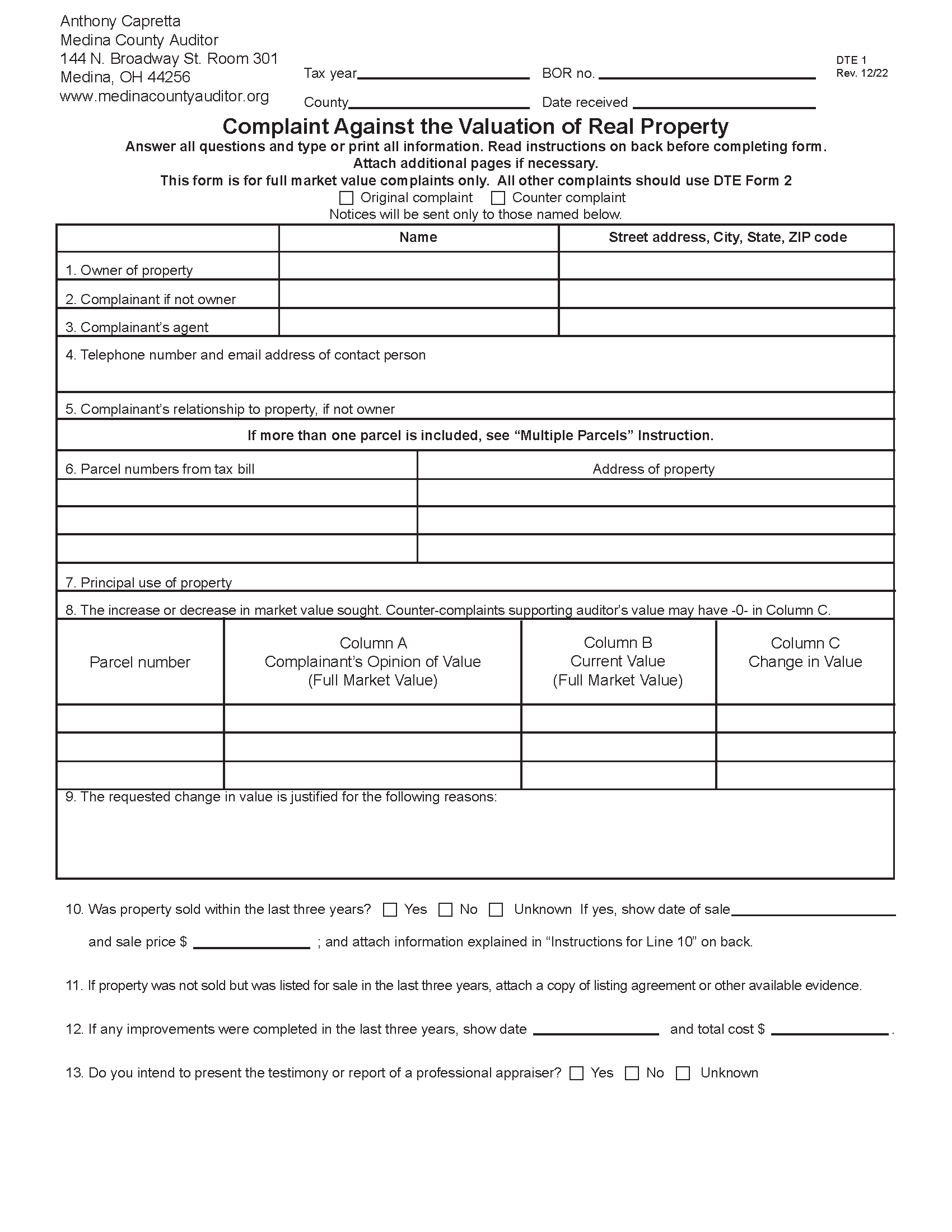

Medina County Real Estate Taxes. The official payment due date for these tax bills is February 12 2021. The official payment due date for these tax bills is February 12 2021. Medina County Administration Building 144 North Broadway Medina OH 44256 Phone 330-725-9748 Fax 330-725-9174. MEDINA COUNTY OHIO Medina County Treasurer John Burke has announced that 78031 first half 2020 property tax bills were mailed on January 13th to county property owners.

Medina County Property Reappraisal Shows Values Going Up Cleveland Com From cleveland.com

Medina County Property Reappraisal Shows Values Going Up Cleveland Com From cleveland.com

The First Half 2020 Real Estate Tax bills were mailed on January 13 th. Where can I pay my real estate tax bill. Medina County Ohio Auditors Office. The Tax Assessor-Collector does not set tax rates or set property values. Taxes paid after the due date will incur a penalty on the following dates. Medina City property owners will see an increase of approximately 32 per.

The First Half 2020 Real Estate Tax bills were mailed on January 13 th.

Medina County is ranked 417th of the 3143 counties for property taxes as a percentage of median income. 710 行 MEDINA OH 44256 005-07B-20-001 981941 WATKINS GEORGE ALBERTA REMSEN. Broadway St Medina OH 44256 Medina. The First Half 2020 Real Estate Tax bills were mailed on January 13 th. Any No HOA Fee 50month100month200month300. For more information on property values please call the Appraisal District at 830741-3035.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

710 行 MEDINA OH 44256 005-07B-20-001 981941 WATKINS GEORGE ALBERTA REMSEN. Medina County Administration Building 144 North Broadway Medina OH 44256 Phone 330-725-9748 Fax 330-725-9174. 100000 x 35 35000. You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth. The official payment due date for these tax bills is February 12 2021.

Source: cleveland.com

Source: cleveland.com

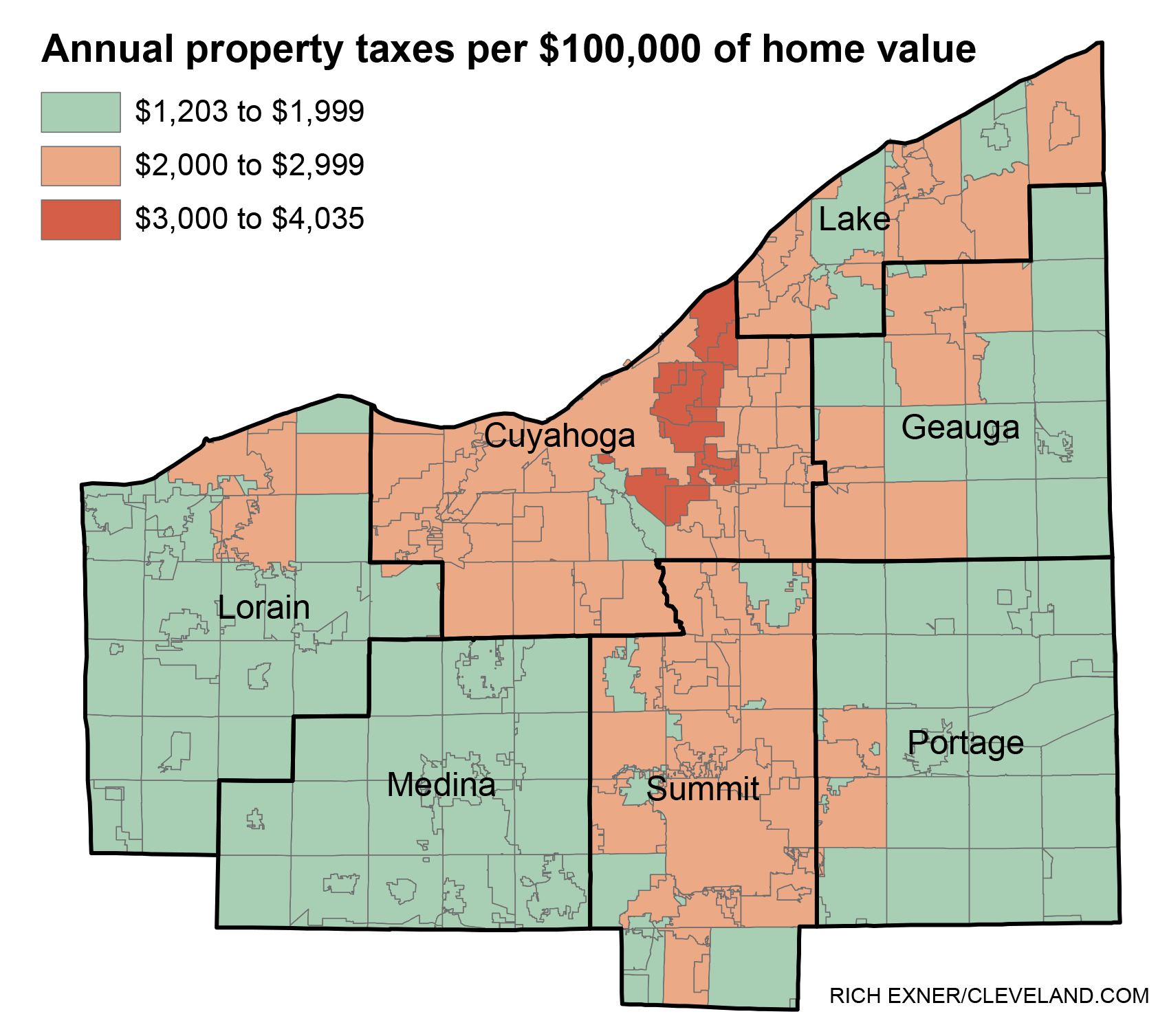

Appraised Value x 35 Assessed Value. Determine the assessed value. Medina County Ohio Auditors Office. The median property tax also known as real estate tax in Medina County is 254000 per year based on a median home value of 18490000 and a median. Where can I pay my real estate tax bill.

Source: cleveland.com

Source: cleveland.com

For more information on how to calculate your real estate taxes check out How to Compute Your Tax Bill. The governing body of each taxing unit sets the units tax rate and the Medina County Appraisal District sets the property values. For more information on property values please call the Appraisal District at 830741-3035. The average yearly property tax paid by Medina County residents amounts to about 339 of their yearly income. Medina City property owners will see an increase of approximately 32 per.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

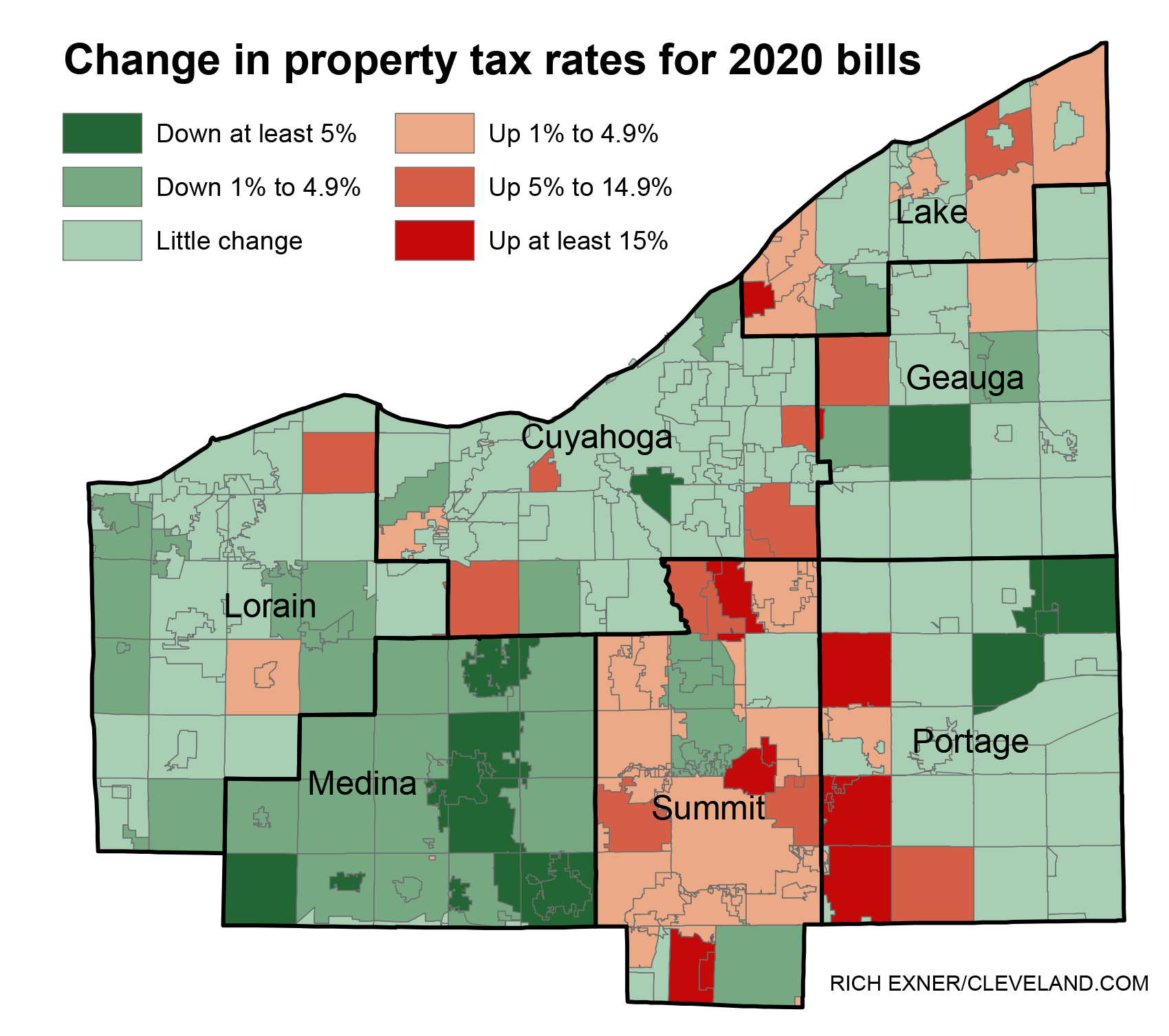

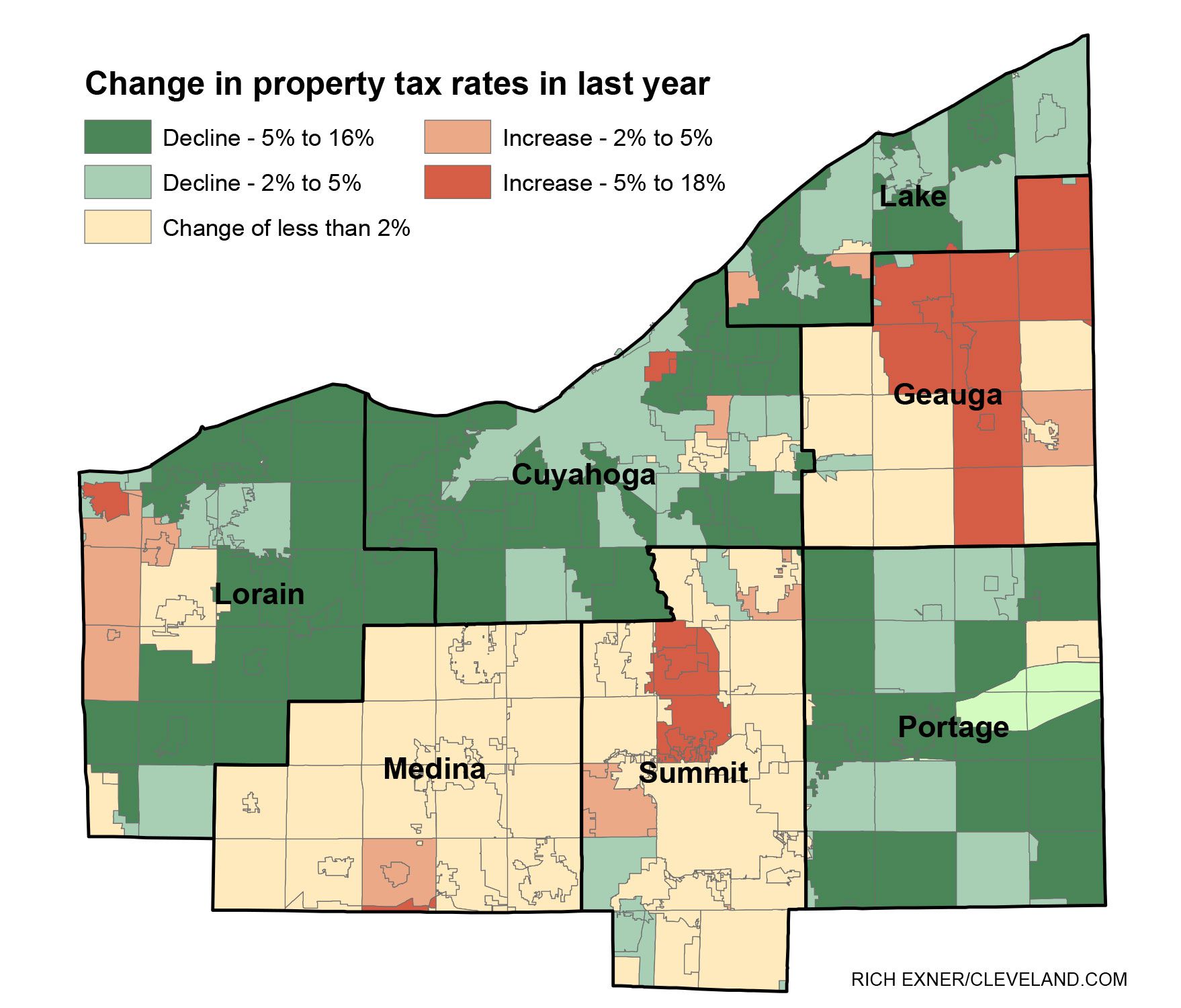

In general taxes remained stable or decreased slightly for tax payers throughout the county. In general taxes remained stable or decreased slightly for tax payers throughout the county. The governing body of each taxing unit sets the units tax rate and the Medina County Appraisal District sets the property values. The median property tax also known as real estate tax in Medina County is 254000 per year based on a median home value of 18490000 and a median. Medina County Administration Building 144 North Broadway Medina OH 44256 Phone 330-725-9748 Fax 330-725-9174.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

The Tax Assessor-Collector does not set tax rates or set property values. 100000 x 35 35000. For more information on how to calculate your real estate taxes check out How to Compute Your Tax Bill. In general taxes remained stable or decreased slightly for tax payers throughout the county. Any No HOA Fee 50month100month200month300.

Source: realtor.com

Source: realtor.com

The Tax Assessor-Collector does not set tax rates or set property values. Medina County Ohio Auditors Office. You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth. MEDINA COUNTY OHIO Medina County Treasurer John Burke has announced that 78031 first half 2020 property tax bills were mailed on January 13th to county property owners. Determine the assessed value.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

Medina County Ohio Auditors Office. The median property tax also known as real estate tax in Medina County is 254000 per year based on a median home value of 18490000 and a median effective property tax. Medina County is ranked 417th of the 3143 counties for property taxes as a percentage of median income. Taxpayers can also make their payments in person at the Treasurers Office in the Medina County Administration Building 144 N. Medina City property owners will see an increase of approximately 32 per.

Source: scriptype.com

Source: scriptype.com

The Tax Assessor-Collector does not set tax rates or set property values. Medina County Ohio Auditors Office. Real Estate Taxes are due on February 12th. Divide Assessed Value in half to Calculate Half-Year Tax Bill Amount. Broadway St Medina OH 44256 Medina.

Source: realtor.com

Source: realtor.com

100000 x 35 35000. The average yearly property tax paid by Medina County residents amounts to about 339 of their yearly income. Medina County Ohio Auditors Office. Medina City property owners will see an increase of approximately 32 per. The First Half 2020 Real Estate Tax bills were mailed on January 13 th.

Source: cleveland.com

Source: cleveland.com

The Tax Assessor-Collector does not set tax rates or set property values. 710 行 MEDINA OH 44256 005-07B-20-001 981941 WATKINS GEORGE ALBERTA REMSEN. The normal office hours of. Medina County Ohio Auditors Office. Treasurer Burke noted that the total amount of first half real estate taxes billed is.

Source: cleveland.com

Source: cleveland.com

You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth. Medina City property owners will see an increase of approximately 32 per. The official payment due date for these tax bills is February 12 2021. In general taxes remained stable or decreased slightly for tax payers throughout the county. 13th - 5 penalty Feb.

Source: realtor.com

Source: realtor.com

100000 x 35 35000. 23 - 10 penalty. The governing body of each taxing unit sets the units tax rate and the Medina County Appraisal District sets the property values. MEDINA COUNTY OHIO Medina County Treasurer John Burke has announced that 78031 first half 2020 property tax bills were mailed on January 13th to county property owners. 13th - 5 penalty Feb.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

100000 x 35 35000. The normal office hours of. The First Half 2020 Real Estate Tax bills were mailed on January 13 th. Homestead Medina County Auditors Office Seals Design Contest. 710 行 MEDINA OH 44256 005-07B-20-001 981941 WATKINS GEORGE ALBERTA REMSEN.

Source: cleveland.com

Source: cleveland.com

You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth. In-depth Medina County OH Property Tax Information. 100000 x 35 35000. For more information on property values please call the Appraisal District at 830741-3035. The Tax Assessor-Collector does not set tax rates or set property values.

Source: medinacountyauditor.org

Source: medinacountyauditor.org

The normal office hours of. 13th - 5 penalty Feb. 100000 x 35 35000. Homestead Medina County Auditor Tax Calculator Tax Calculator. Medina County Administration Building 144 North Broadway Medina OH 44256 Phone 330-725-9748 Fax 330-725-9174.

You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth. For more information on how to calculate your real estate taxes check out How to Compute Your Tax Bill. Homestead Medina County Auditors Office Seals Design Contest. Real Estate Taxes are due on February 12th. Medina County Ohio Auditors Office.

Source: cleveland.com

Source: cleveland.com

Homestead Medina County Auditors Office Seals Design Contest. The median property tax also known as real estate tax in Medina County is 254000 per year based on a median home value of 18490000 and a median effective property tax. 710 行 MEDINA OH 44256 005-07B-20-001 981941 WATKINS GEORGE ALBERTA REMSEN. Taxpayers can also make their payments in person at the Treasurers Office in the Medina County Administration Building 144 N. The normal office hours of.

Source: cleveland.com

Source: cleveland.com

For more information on property values please call the Appraisal District at 830741-3035. 100000 x 35 35000. Taxes paid after the due date will incur a penalty on the following dates. Determine the assessed value. You can pay your tax bill in person at the Treasurers Office located at 144 North Broadway Street in Medina or at one of our convenient 24-Hour Drive-Up Drop-Off boxes in Medina Brunswick Lodi and Wadsworth.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title medina county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.