Your Michigan capital gains tax real estate images are available. Michigan capital gains tax real estate are a topic that is being searched for and liked by netizens today. You can Find and Download the Michigan capital gains tax real estate files here. Get all free photos and vectors.

If you’re searching for michigan capital gains tax real estate images information connected with to the michigan capital gains tax real estate keyword, you have pay a visit to the ideal blog. Our website always gives you hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Michigan Capital Gains Tax Real Estate. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. If you sell the property now for net proceeds of 350000 youll. Families who stay in the same home for decades suffer a tax.

How To Calculate Capital Gains Tax On Real Estate Investment Property From realwealthnetwork.com

How To Calculate Capital Gains Tax On Real Estate Investment Property From realwealthnetwork.com

Families who stay in the same home for decades suffer a tax. In some counties the tax rate can be up to 0751000 of value transferred There are transfer tax exemptions and a professional realtor will be able to help you take full advantage of them. Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. Individuals can exclude up to 250000 of capital gains from the sale of their primary residence or 500000 for a married couple. Generally you will pay capital gains tax whenever you sell investment or business property.

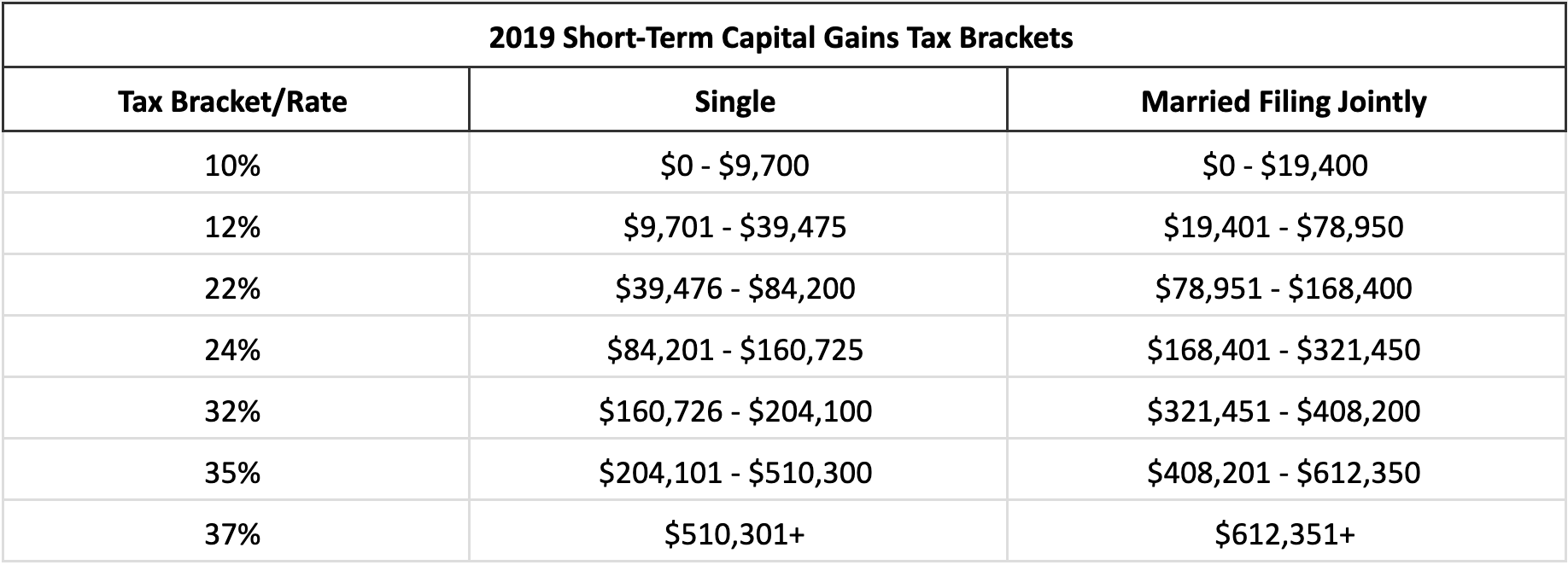

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate. Your income and filing status make your capital gains tax rate on real estate 15. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. Use this calculator to help estimate capital gain taxes due on your transactions. The Capital Gains Tax Return BIR Form No. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank AAB or Revenue Collection Officer RCO of the Revenue District Office RDO having jurisdiction over the place where the property being transferred is located.

Therefore you would owe 2250. I purchased the property for 28500 and sold for 68000. If you sell the property now for net proceeds of 350000 youll. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. As a single person you would pay taxes on that extra 50000 in income at the 24 federal tax rate.

Source: hackyourwealth.com

Source: hackyourwealth.com

The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five and seven years respectively. At 22 your capital gains tax on this real estate sale would be 3300. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. A difference will only occur for one of the following reasons.

Source: forbes.com

Source: forbes.com

Zero percent 15 percent or 20 percent. 52 行 Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. 500000 of capital gains on real estate if youre married and filing jointly. Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

Source: taxfoundation.org

Source: taxfoundation.org

At 22 your capital gains tax on this real estate sale would be 3300. However if youve owned the property for longer than one calendar year you are now responsible for long-term capital gains tax. The Capital Gains Tax Return BIR Form No. Your income and filing status make your capital gains tax rate on real estate 15. When you own an asset for more than a year and sell it for a profit the IRS classifies that income as a long-term capital gain.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property. I have a question regarding the Capital Gains tax I will have to pay on the sale on my vacant hunting land I sold in Michigan in 2016. Individuals can exclude up to 250000 of capital gains from the sale of their primary residence or 500000 for a married couple. Zero percent 15 percent or 20 percent. I owned the property for six years and from what I have researched I will will owe 15 because I owned the property longer than one year.

Source: listwithclever.com

Source: listwithclever.com

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. The MI-1040D is filed only when there is a difference between your federal capital gainslosses and Michigan capital gainslosses. The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. As a single person you would pay taxes on that extra 50000 in income at the 24 federal tax rate. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Its 055 for every 500 of value transferred. However if youve owned the property for longer than one calendar year you are now responsible for long-term capital gains tax. At 22 your capital gains tax on this real estate sale would be 3300. Requires only 7 inputs into a simple Excel spreadsheet. Its 055 for every 500 of value transferred.

Source: canr.msu.edu

Source: canr.msu.edu

Your income and filing status make your capital gains tax rate on real estate 15. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Additional inputs available for calculating adjusted tax basis and depreciation recapture including depreciation debt and closing costs. The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five and seven years respectively. Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. Generally you will pay capital gains tax whenever you sell investment or business property. However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property.

Source: propertycashin.com

Source: propertycashin.com

The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. There is also a county transfer tax rate in Michigan. I have a question regarding the Capital Gains tax I will have to pay on the sale on my vacant hunting land I sold in Michigan in 2016. However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or.

Source: atlaslawoffice.com

Source: atlaslawoffice.com

The gain is then taxed at a maximum of 15 at the federal level and then Michigan state taxes would also apply at ordinary tax rates which will vary depending on your overall income. Therefore you would owe 2250. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. 500000 of capital gains on real estate if youre married and filing jointly. However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property.

Source: taxfoundation.org

Source: taxfoundation.org

Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate. In some counties the tax rate can be up to 0751000 of value transferred There are transfer tax exemptions and a professional realtor will be able to help you take full advantage of them. If you sell the property now for net proceeds of 350000 youll. For example if you bought a home 10 years ago for 200000.

Source: moneycrashers.com

Source: moneycrashers.com

Federal taxes on your net capital gain s may vary depending on your marginal income tax bracket and the holding period of the asset. Your income and filing status make your capital gains tax rate on real estate 15. The gain is then taxed at a maximum of 15 at the federal level and then Michigan state taxes would also apply at ordinary tax rates which will vary depending on your overall income. For example if you bought a home 10 years ago for 200000. Sale of an asset that was acquired before October 1 1967 the date the Michigan Income Tax Act went into effect.

Source: upnest.com

Source: upnest.com

A difference will only occur for one of the following reasons. For example if you bought a home 10 years ago for 200000. Federal taxes on your net capital gain s may vary depending on your marginal income tax bracket and the holding period of the asset. Which rate your capital. 500000 of capital gains on real estate if youre married and filing jointly.

Source: upnest.com

Source: upnest.com

The MI-1040D is filed only when there is a difference between your federal capital gainslosses and Michigan capital gainslosses. Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. 1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank AAB or Revenue Collection Officer RCO of the Revenue District Office RDO having jurisdiction over the place where the property being transferred is located. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five and seven years respectively.

Source: forbes.com

Source: forbes.com

If you acquired this property as part of an inheritance then your basis is the fair market value of the property on the day that you inherited it. However IRC Section 1031 provides an exception that allows you to defer the tax on the gain if you reinvest the proceeds in similar property. Use this calculator to help estimate capital gain taxes due on your transactions. I owned the property for six years and from what I have researched I will will owe 15 because I owned the property longer than one year. Requires only 7 inputs into a simple Excel spreadsheet.

Source: upnest.com

Source: upnest.com

However if youve owned the property for longer than one calendar year you are now responsible for long-term capital gains tax. Zero percent 15 percent or 20 percent. The MI-1040D is filed only when there is a difference between your federal capital gainslosses and Michigan capital gainslosses. 500000 of capital gains on real estate if youre married and filing jointly. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

Source: joecunninghampc.com

Source: joecunninghampc.com

Zero percent 15 percent or 20 percent. Capital Gains Tax Estimator. Use this calculator to help estimate capital gain taxes due on your transactions. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate. Therefore you would owe 2250.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title michigan capital gains tax real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.