Your Mobile county real estate taxes images are available. Mobile county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Mobile county real estate taxes files here. Find and Download all royalty-free images.

If you’re searching for mobile county real estate taxes pictures information linked to the mobile county real estate taxes interest, you have visit the ideal blog. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Mobile County Real Estate Taxes. Only real estate and mobile home taxes may be paid online. Substantial discounts are extended for early payment. We maintain yearly records on over 550 thousand parcels. Our online payment portal is convenient secure and easy to use.

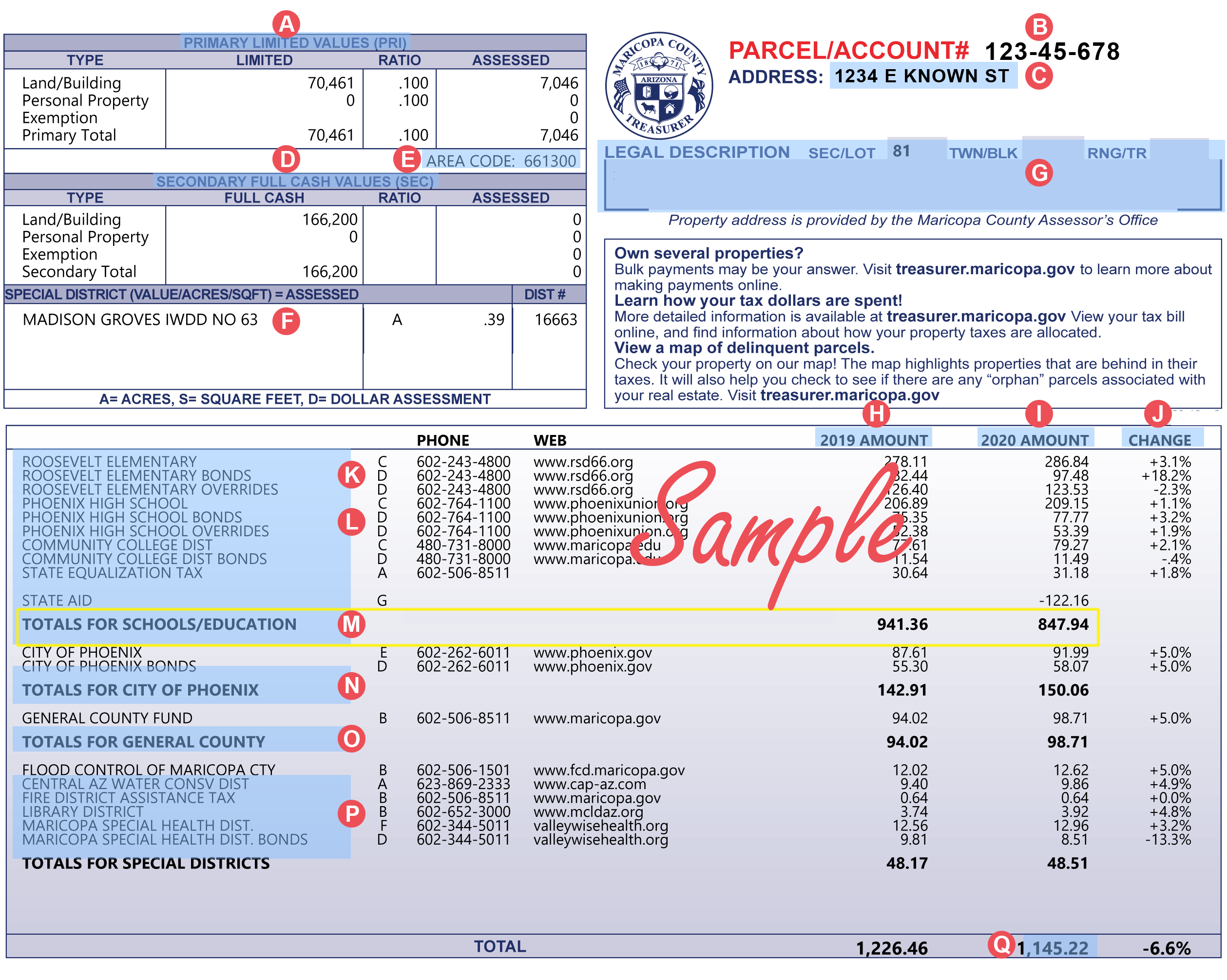

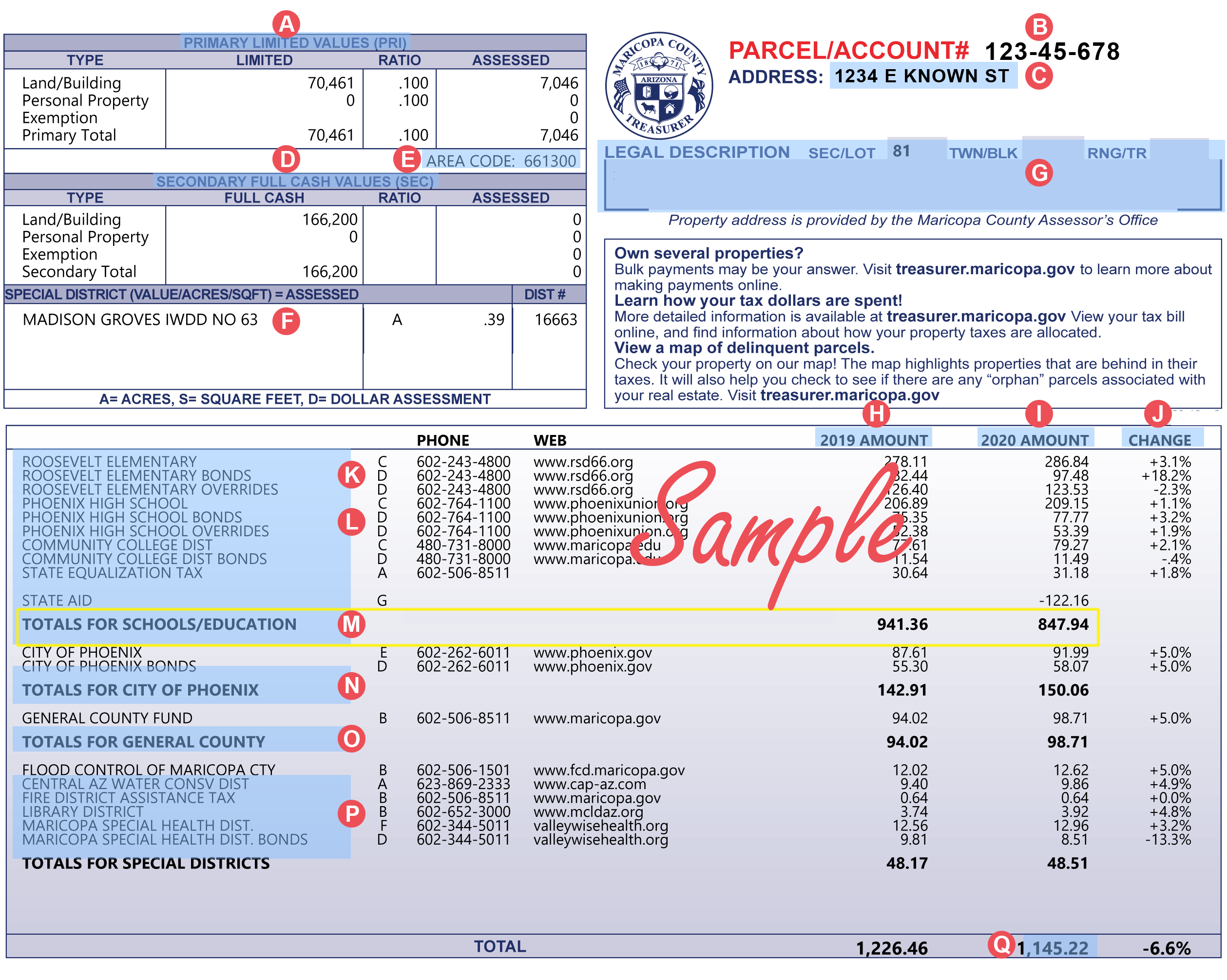

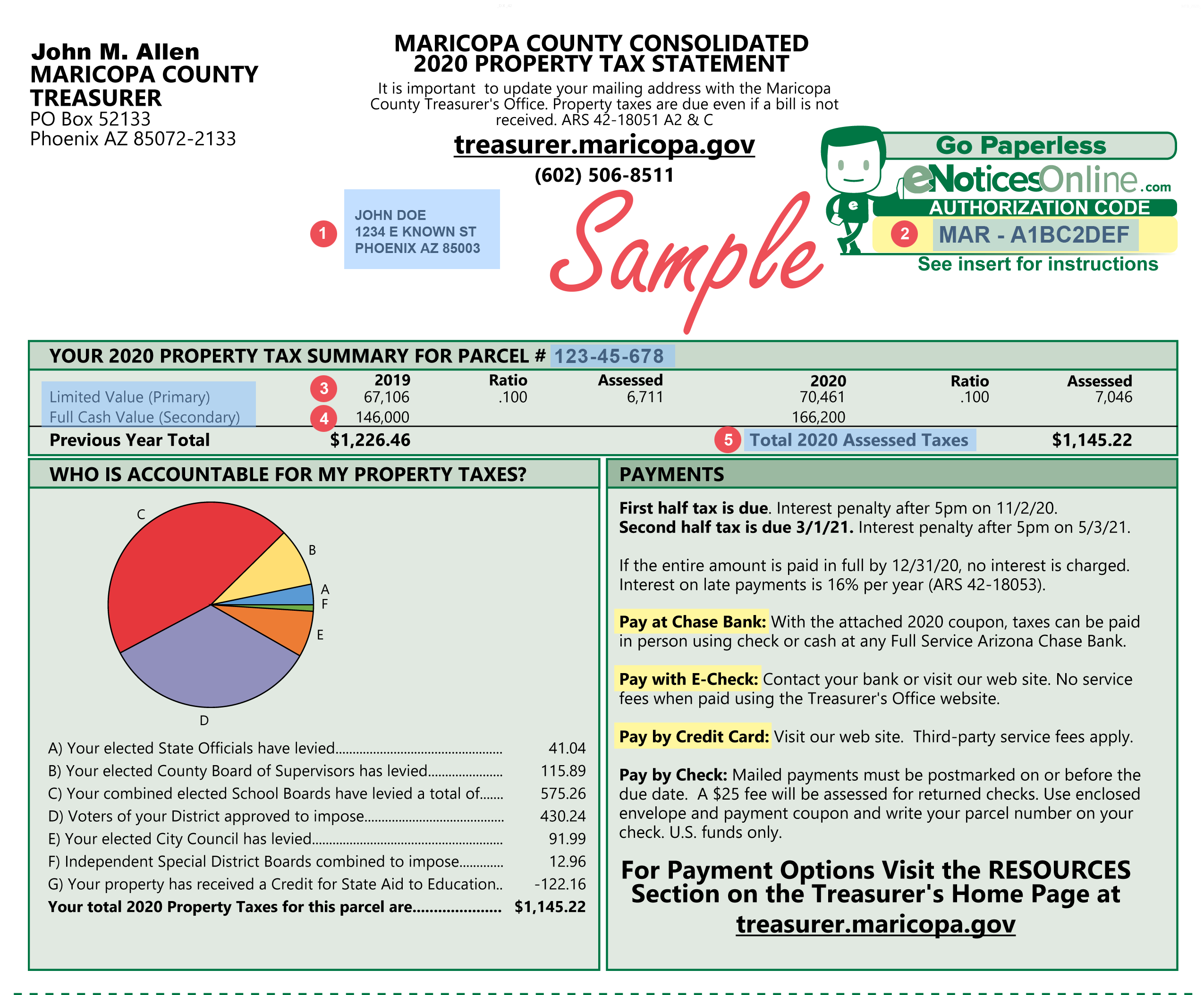

Tax Bill From treasurer.maricopa.gov

Tax Bill From treasurer.maricopa.gov

A taxpayer who uses the installment method pays an estimated tax equal to the actual taxes for the preceding year. Taxes have to be paid in full and at one time unless the property owner has filed for the installment program or for homestead tax deferrals. Our online payment portal is convenient secure and easy to use. In such cases the mobile home owner is required to obtain a Declaration of Real Property RP from the Property Appraisers Office. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Customers making tax payments only DO NOT need an appointment.

Taxes have to be paid in full and at one time unless the property owner has filed for the installment program or for homestead tax deferrals.

The interest rate is 4 per annum for delinquent. The amount billed for the 2020 year was approximately 64000. The payment schedule is. Credit or debit card payment for other property types may be made by phoning our office 719 520-7900. Customers making tax payments only DO NOT need an appointment. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are.

Source: it.pinterest.com

Source: it.pinterest.com

Ankerson Wendi Mcclain Patrick G Ankerson Jr. In 2021 the interest rate is 9 per annum for delinquent real estate taxes less than 10000 and 15 per annum will be added on delinquent real estate taxes exceeding 10000. Customers are encouraged topay onlineinstead of coming in person. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Ankerson Wendi Mcclain Patrick G Ankerson Jr.

Source: realtor.com

Source: realtor.com

Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are. Ankerson Wendi Mcclain Patrick G Ankerson Jr. We maintain yearly records on over 550 thousand parcels. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. 2021 Real Estate Assessments Now Available Average Residential Increase 425 Real Estate Tax Rate Reduction.

Source: assessor.lacounty.gov

Source: assessor.lacounty.gov

Substantial discounts are extended for early payment. The payment schedule is. The interest rate is 4 per annum for delinquent. In accordance with Illinois law tax bills are issued to mobile homeowners based on the age of. Customers making tax payments only DO NOT need an appointment.

Source: zillow.com

Source: zillow.com

RCW 8245080 subjects the seller of real estate to the payment of the excise tax and RCW 8208050and 8212020 subjects the buyer or user of personal property to the retail sales or use tax. There are approximately 660 mobile home bills issued in Crawford County. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are. Real Estate Mobile Home Tax. Only real estate and mobile home taxes may be paid online.

Source: hrblock.com

Source: hrblock.com

In such cases the mobile home owner is required to obtain a Declaration of Real Property RP from the Property Appraisers Office. Property and mobile home tax collections take place in March called the first half collection and August called. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are. RCW 8245080 subjects the seller of real estate to the payment of the excise tax and RCW 8208050and 8212020 subjects the buyer or user of personal property to the retail sales or use tax. Real Estate Mobile Home Tax.

Source: zillow.com

Source: zillow.com

30 14 the total estimated taxes discounted 6. Do manufactured homes or mobile home purchases have to be reported. Therefore if the transfer is subject to the excise tax it is the liability of. The first half of your real estate taxes are due by midnight on April 30 th. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Source: revenue.alabama.gov

Source: revenue.alabama.gov

Property and mobile home tax collections take place in March called the first half collection and August called. All other transactions require an appointment. The interest rate is 4 per annum for delinquent. In accordance with Illinois law tax bills are issued to mobile homeowners based on the age of. A taxpayer who uses the installment method pays an estimated tax equal to the actual taxes for the preceding year.

Source: wycokck.org

Source: wycokck.org

Modest Investments Included in FY 2022 Budget Proposal. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Modest Investments Included in FY 2022 Budget Proposal. Five months elapse before real property owners can be penalized for non-payment of taxes. There are approximately 660 mobile home bills issued in Crawford County.

Source: zillow.com

Source: zillow.com

This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. In accordance with Illinois law tax bills are issued to mobile homeowners based on the age of. Mobile Home Tax. A taxpayer who uses the installment method pays an estimated tax equal to the actual taxes for the preceding year. 951 Royal Oak Ct.

Source: treasurer.maricopa.gov

Source: treasurer.maricopa.gov

Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property. Ohio Real Estate Taxes commonly referred to as property taxes and Mobile Home taxes are collected by the county treasurer twice a year based on the assessment of value made by the county auditor. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Taxes have to be paid in full and at one time unless the property owner has filed for the installment program or for homestead tax deferrals. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Source: realtor.com

Source: realtor.com

Do manufactured homes or mobile home purchases have to be reported. Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property. In such cases the mobile home owner is required to obtain a Declaration of Real Property RP from the Property Appraisers Office. 30 14 the total estimated taxes discounted 6. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years.

Source: realtor.com

Source: realtor.com

Only real estate and mobile home taxes may be paid online. Do manufactured homes or mobile home purchases have to be reported. Real estate taxes are paid one year in arrears. Mobile Home Tax. Real Estate Mobile Home Tax.

Source: realtor.com

Source: realtor.com

The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. There are approximately 660 mobile home bills issued in Crawford County. RCW 8245080 subjects the seller of real estate to the payment of the excise tax and RCW 8208050and 8212020 subjects the buyer or user of personal property to the retail sales or use tax. In 2021 the interest rate is 9 per annum for delinquent real estate taxes less than 10000 and 15 per annum will be added on delinquent real estate taxes exceeding 10000.

Source: zillow.com

Source: zillow.com

2021 Real Estate Assessments Now Available Average Residential Increase 425 Real Estate Tax Rate Reduction. In Mobile city the municipal rate is 70 which brings the total millage rate for residents of Mobile city to 635. We maintain yearly records on over 550 thousand parcels. A taxpayer who uses the installment method pays an estimated tax equal to the actual taxes for the preceding year. The amount billed for the 2020 year was approximately 64000.

Source: smartasset.com

Source: smartasset.com

Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. In accordance with Illinois law tax bills are issued to mobile homeowners based on the age of. Mobile Home Tax. In such cases the mobile home owner is required to obtain a Declaration of Real Property RP from the Property Appraisers Office.

Source: treasurer.maricopa.gov

Source: treasurer.maricopa.gov

The payment schedule is. This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. A mobile home is taxed as real property when the owner of the home is also the owner of the land upon which the unit is placed or affixed. Customers are encouraged topay onlineinstead of coming in person. The amount billed for the 2020 year was approximately 64000.

Source: zillow.com

Source: zillow.com

We maintain yearly records on over 550 thousand parcels. There are approximately 660 mobile home bills issued in Crawford County. In the year 2020 property owners will be paying 2019 real estate taxes Real estate tax notices are mailed to the property owners in either late December or early January. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Customers are encouraged topay onlineinstead of coming in person.

Source:

Source:

1st Installment Due Jun. We maintain yearly records on over 550 thousand parcels. A taxpayer who uses the installment method pays an estimated tax equal to the actual taxes for the preceding year. 2021 Real Estate Assessments Now Available Average Residential Increase 425 Real Estate Tax Rate Reduction. Ankerson Wendi Mcclain Patrick G Ankerson Jr.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mobile county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.