Your Montgomery county md real estate taxes images are available. Montgomery county md real estate taxes are a topic that is being searched for and liked by netizens today. You can Get the Montgomery county md real estate taxes files here. Download all royalty-free photos and vectors.

If you’re searching for montgomery county md real estate taxes pictures information related to the montgomery county md real estate taxes keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Montgomery County Md Real Estate Taxes. Enter one of the following to calculate estimated property tax and other non-tax charges. The increase in the FY21 budget is 21 percent. This tax is also customarily split. Taxpayers may also pay by mail with a check payable to.

Montgomery County Md Foreclosures And Foreclosed Homes For Sale Realtor Com From realtor.com

Montgomery County Md Foreclosures And Foreclosed Homes For Sale Realtor Com From realtor.com

Any No HOA Fee 50month100month200month300. We hope you find the information inside easily accessible and useful. Payments will be accepted during the hours of 8 am. Due to the state of emergency related to COVID-19 the Countys Tax Sale originally scheduled for June 8 2020 has been postponed to June 14 2021. If you have any questions or concerns please do not hesitate to contact us. Montgomery County Tax Records Maryland httpsappsmontgomerycountymdgovrealpropertytaxDefaultaspx View Montgomery County real property tax account information and bill payment system including property tax.

Taxpayers may also pay by mail with a check payable to.

Some areas in Montgomery County are part of a development tax district which may require the payment of a special assessment tax fee or charge by the homeowner. This screen allows you to search the Real Property database and display property records. The FY21 budget stays within the Countys Charter Limit on property taxes. The Montgomery County recordation rates are now 890 per 1000 for the first 500K and 1350 per 1000 on the amount in excess. Montgomery County Real Property Tax - Personal Check Payment. Payments will be accepted during the hours of 8 am.

Source: gcaar.com

Source: gcaar.com

These charges may be different in the next fiscal year. Click Here for Information about Tax Payments and Property Transfer Processing. Enter an address or account number and the system will estimate real property tax plus other non-tax charges a new owner will pay in the first full fiscal year of ownership. These charges may be different in the next fiscal year. More on Montgomery County MD real estate taxes Search the Multiple Listing Service for Montgomery County MDHomes for Sale Click on the map to refine your search according to your needs.

Source: eliresidential.com

Source: eliresidential.com

Montgomery Countys income tax rate is 32. All non-tax charges for example Solid Waste Water Quality Protection Bay Restoration Fund WSSC are the charges in the current fiscal year. More on Montgomery County MD real estate taxes Search the Multiple Listing Service for Montgomery County MDHomes for Sale Click on the map to refine your search according to your needs. The Real Property Search Page may be unavailable before 700 AM for maintenance. Click Here for Information about Tax Payments and Property Transfer Processing.

Source: redfin.com

Source: redfin.com

The increase in the FY21 budget is 21 percent. All non-tax charges for example Solid Waste Water Quality Protection Bay Restoration Fund WSSC are the charges in the current fiscal year. All property tax and income tax revenue is collected by the State of Maryland and Montgomery County which then distribute Rockvilles share to the City. County Property Tax is the sum of the General Fund tax and several special fund taxes. Estimated Real Property Tax and Other Non-tax Charges.

Source: redfin.com

Source: redfin.com

The FY21 budget stays within the Countys Charter Limit on property taxes. Welcome to the Montgomery County Real Estate Tax Information site. The Real Property Search Page may be unavailable before 700 AM for maintenance. Due to the state of emergency related to COVID-19 the Countys Tax Sale originally scheduled for June 8 2020 has been postponed to June 14 2021. For questions please call.

Source: zillow.com

Source: zillow.com

Montgomery County Tax Records Maryland httpsappsmontgomerycountymdgovrealpropertytaxDefaultaspx View Montgomery County real property tax account information and bill payment system including property tax. This tax is also customarily split. The average County homeowner. County Property Tax is the sum of the General Fund tax and several special fund taxes. Any No HOA Fee 50month100month200month300.

Source: zillow.com

Source: zillow.com

County Property Tax is the sum of the General Fund tax and several special fund taxes. Montgomery County Real Property Tax - Personal Check Payment. Taxpayers may also pay by mail with a check payable to. Montgomery Countys income tax rate is 32. Due to the state of emergency related to COVID-19 the Countys Tax Sale originally scheduled for June 8 2020 has been postponed to June 14 2021.

Source: www2.montgomerycountymd.gov

Source: www2.montgomerycountymd.gov

Montgomery Countys income tax rate is 32. Montgomery County Tax Records Maryland httpsappsmontgomerycountymdgovrealpropertytaxDefaultaspx View Montgomery County real property tax account information and bill payment system including property tax. This tax is also customarily split. Click here for a glossary. All real property real estate in Montgomery County is subject to taxation except that which is specifically exempt.

More on Montgomery County MD real estate taxes Search the Multiple Listing Service for Montgomery County MDHomes for Sale Click on the map to refine your search according to your needs. This property is located in an existing development district. This tax is also customarily split. We hope you find the information inside easily accessible and useful. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: zillow.com

Source: zillow.com

Enter one of the following to calculate estimated property tax and other non-tax charges. Prepayments in person at the Division of Treasury can be made in the form of cash or check. Search all Montgomery County Government agencies including the Washington Suburban Sanitary Commission WSSC Montgomery Parks Montgomery Planning Montgomery College Housing Opportunities Commission Montgomery County Public Schools County Council and more. Each property is assessed every three years by the State Department of Assessments and Taxation SDAT. Payments will be accepted during the hours of 8 am.

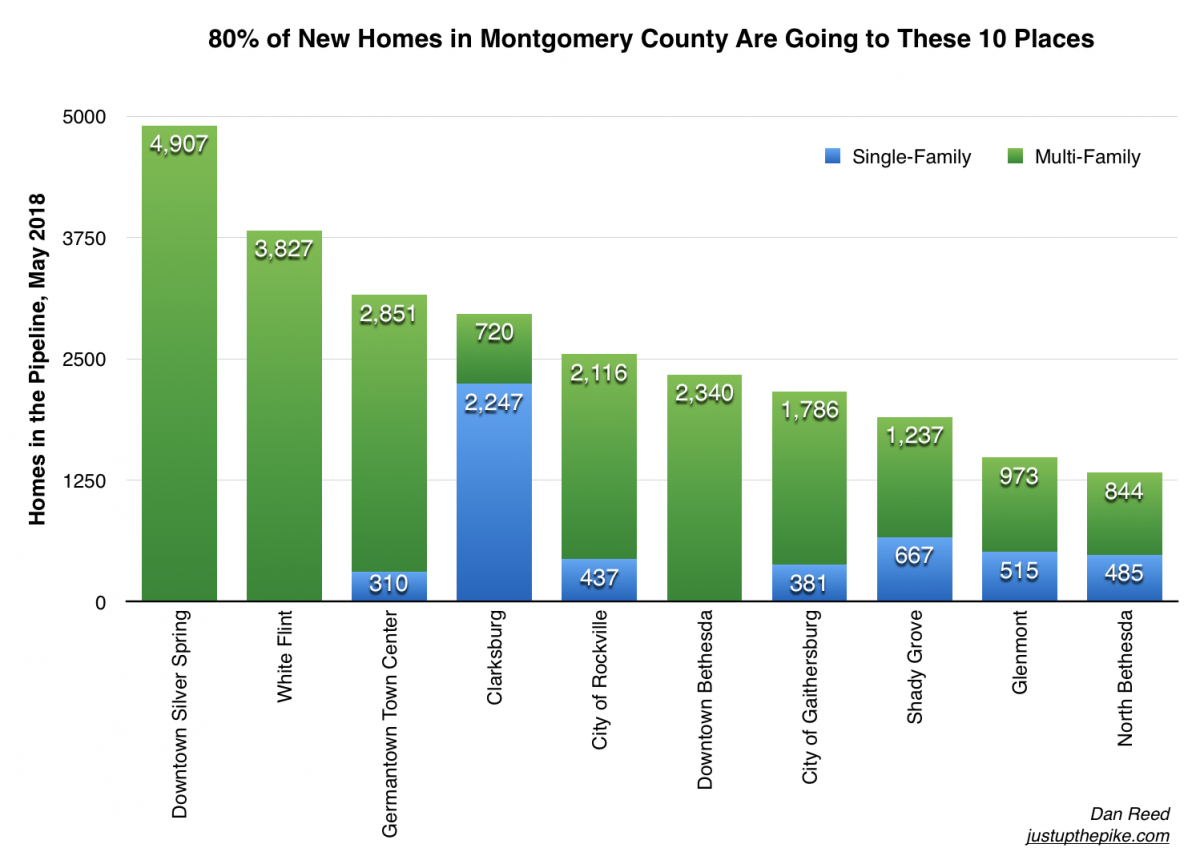

Source: ggwash.org

Source: ggwash.org

If you have any questions or concerns please do not hesitate to contact us. The increase in the FY21 budget is 21 percent. Click Here for Information about Tax Payments and Property Transfer Processing. We hope you find the information inside easily accessible and useful. Montgomery County Tax Records Maryland httpsappsmontgomerycountymdgovrealpropertytaxDefaultaspx View Montgomery County real property tax account information and bill payment system including property tax.

Source: villagesettlements.com

Source: villagesettlements.com

Each property is assessed every three years by the State Department of Assessments and Taxation SDAT. This screen allows you to search the Real Property database and display property records. For questions please call. In-depth Montgomery County MD Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. All real property real estate in Montgomery County is subject to taxation except that which is specifically exempt.

Source: realtor.com

Source: realtor.com

Some areas in Montgomery County are part of a development tax district which may require the payment of a special assessment tax fee or charge by the homeowner. The check should be mailed to the following address. All property tax and income tax revenue is collected by the State of Maryland and Montgomery County which then distribute Rockvilles share to the City. All real property real estate in Montgomery County is subject to taxation except that which is specifically exempt. The only amount that you will be allowed to pay is equal to the amount on the current levy year County Real Property Tax that is.

Source: smartasset.com

Source: smartasset.com

The Montgomery County recordation rates are now 890 per 1000 for the first 500K and 1350 per 1000 on the amount in excess. Each property is assessed every three years by the State Department of Assessments and Taxation SDAT. The check should be mailed to the following address. For questions please call. Click here for a glossary.

Source: montgomerycountymd.gov

Source: montgomerycountymd.gov

Some areas in Montgomery County are part of a development tax district which may require the payment of a special assessment tax fee or charge by the homeowner. Prepayments in person at the Division of Treasury can be made in the form of cash or check. The FY21 budget stays within the Countys Charter Limit on property taxes. The Montgomery County recordation rates are now 890 per 1000 for the first 500K and 1350 per 1000 on the amount in excess. Payments will be accepted during the hours of 8 am.

Source:

Source:

No search results found in the MC311. The check should be mailed to the following address. More on Montgomery County MD real estate taxes Search the Multiple Listing Service for Montgomery County MDHomes for Sale Click on the map to refine your search according to your needs. All non-tax charges for example Solid Waste Water Quality Protection Bay Restoration Fund WSSC are the charges in the current fiscal year. Enter one of the following to calculate estimated property tax and other non-tax charges.

Source: zillow.com

Source: zillow.com

Montgomery County Property Tax Rates Photo credit. Due to the state of emergency related to COVID-19 the Countys Tax Sale originally scheduled for June 8 2020 has been postponed to June 14 2021. The FY21 budget stays within the Countys Charter Limit on property taxes. County Property Tax is the sum of the General Fund tax and several special fund taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: realtor.com

Source: realtor.com

All property tax and income tax revenue is collected by the State of Maryland and Montgomery County which then distribute Rockvilles share to the City. Montgomery Countys income tax rate is 32. The average County homeowner. For example the total tax for a property assessed at 250000 in Montgomery County would be 2335 or 0934 of the homes assessed value while the tax bill for the same property in Baltimore County would be 3798 or 1519 of the homes assessed value. The check should be mailed to the following address.

Source: redfin.com

Source: redfin.com

Some areas in Montgomery County are part of a development tax district which may require the payment of a special assessment tax fee or charge by the homeowner. Due to the state of emergency related to COVID-19 the Countys Tax Sale originally scheduled for June 8 2020 has been postponed to June 14 2021. Estimated Real Property Tax and Other Non-tax Charges. Taxpayers may also pay by mail with a check payable to. The increase in the FY21 budget is 21 percent.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title montgomery county md real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.