Your Moving expenses real estate commission images are available. Moving expenses real estate commission are a topic that is being searched for and liked by netizens now. You can Download the Moving expenses real estate commission files here. Download all free vectors.

If you’re searching for moving expenses real estate commission images information linked to the moving expenses real estate commission interest, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

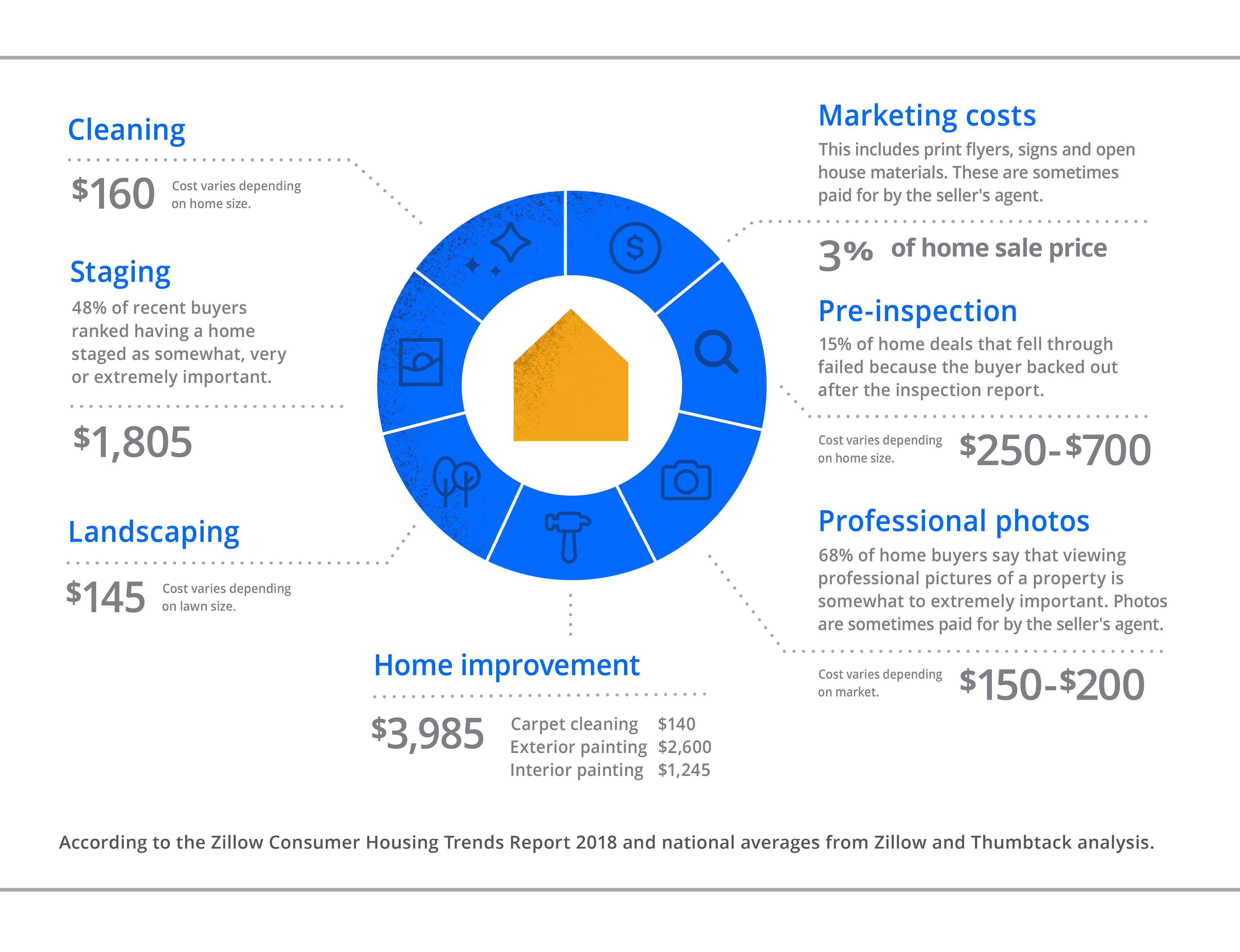

Moving Expenses Real Estate Commission. Can you deduct a real estate brokers commission as part of my moving expenses when I moved to a new city and the broker found me my new apartment. Total deductible moving expenses line 3 8400 Minus. Travel expenses for the move are deductible including transportation and lodging for you and members of your household including pets. The commission is calculated based on the percentage of the propertys sold price the percentage of which can be negotiated.

Reimbursement included in box 13 of Form W-2 line 4 7200 Deduction for moving expenses line 5 1200. From the CRA documentation for Moving Expenses. The expenses must be itemized and only specific expenses may be paid. Can you deduct a real estate brokers commission as part of my moving expenses when I moved to a new city and the broker found me my new apartment. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for. If an employee or self-employed individuals total moving expenses eligible for deduction exceed income at the new work location the excess expenses can be deducted in a subsequent year to the extent of the income at that work location for that subsequent year.

SC LLR can assist you with examination information and materials continuing education requirements and.

You may need to document that the move is required by your business. Many costs are deductible as moving expenses including. The expenses must be itemized and only specific expenses may be paid. Commission fees generally range from 25 per cent to 395 per cent for the first 350k - 500k of the sale price then around 2 for anything over and above that. If an employee or self-employed individuals total moving expenses eligible for deduction exceed income at the new work location the excess expenses can be deducted in a subsequent year to the extent of the income at that work location for that subsequent year. The expenses must also be for a business purpose.

Source: zillow.com

Source: zillow.com

From the CRA documentation for Moving Expenses. A real estate broker typically receives a real estate commission for successfully completing a sale. SC LLR can assist you with examination information and materials continuing education requirements and. The expenses must also be for a business purpose. 3 Expenses incurred in defending the estate against claims described in section 2053 a 3 are deductible to the extent permitted by 202053-1 if the expenses are incurred incident to the assertion of defenses to the claim available under the applicable law even if the estate ultimately does not prevail.

But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for. Eligible moving expenses include real estate commissions and legal fees transportation and storage costs travel expenses including meals temporary living expenses utility hookup and. You will find what is and is not a deductible moving expense in IRS Pub. That is not a deductible moving expense. The expenses must be itemized and only specific expenses may be paid.

Source: br.pinterest.com

Source: br.pinterest.com

That is not a deductible moving expense. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for. Total deductible moving expenses line 3 8400 Minus. To be able to claim moving expenses on your Canadian Federal income tax return your move has to meet the following conditions. The expenses must also be for a business purpose.

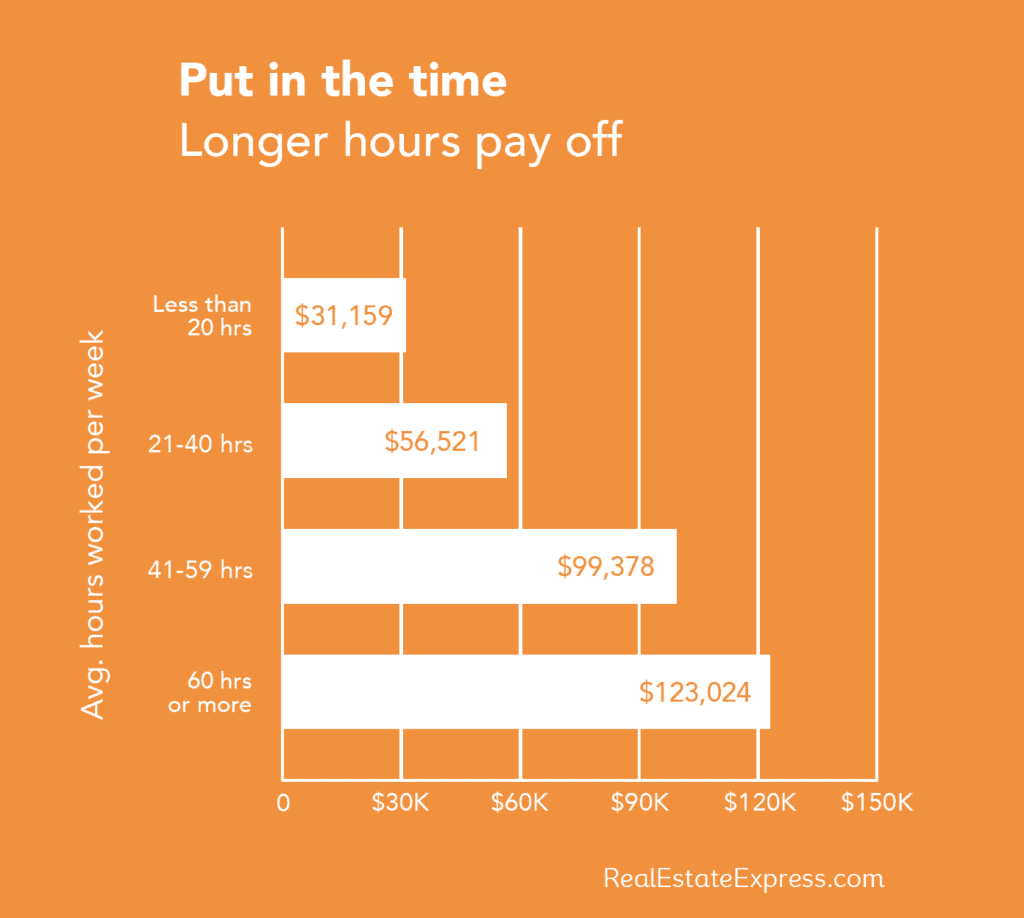

Source: realestateexpress.com

Source: realestateexpress.com

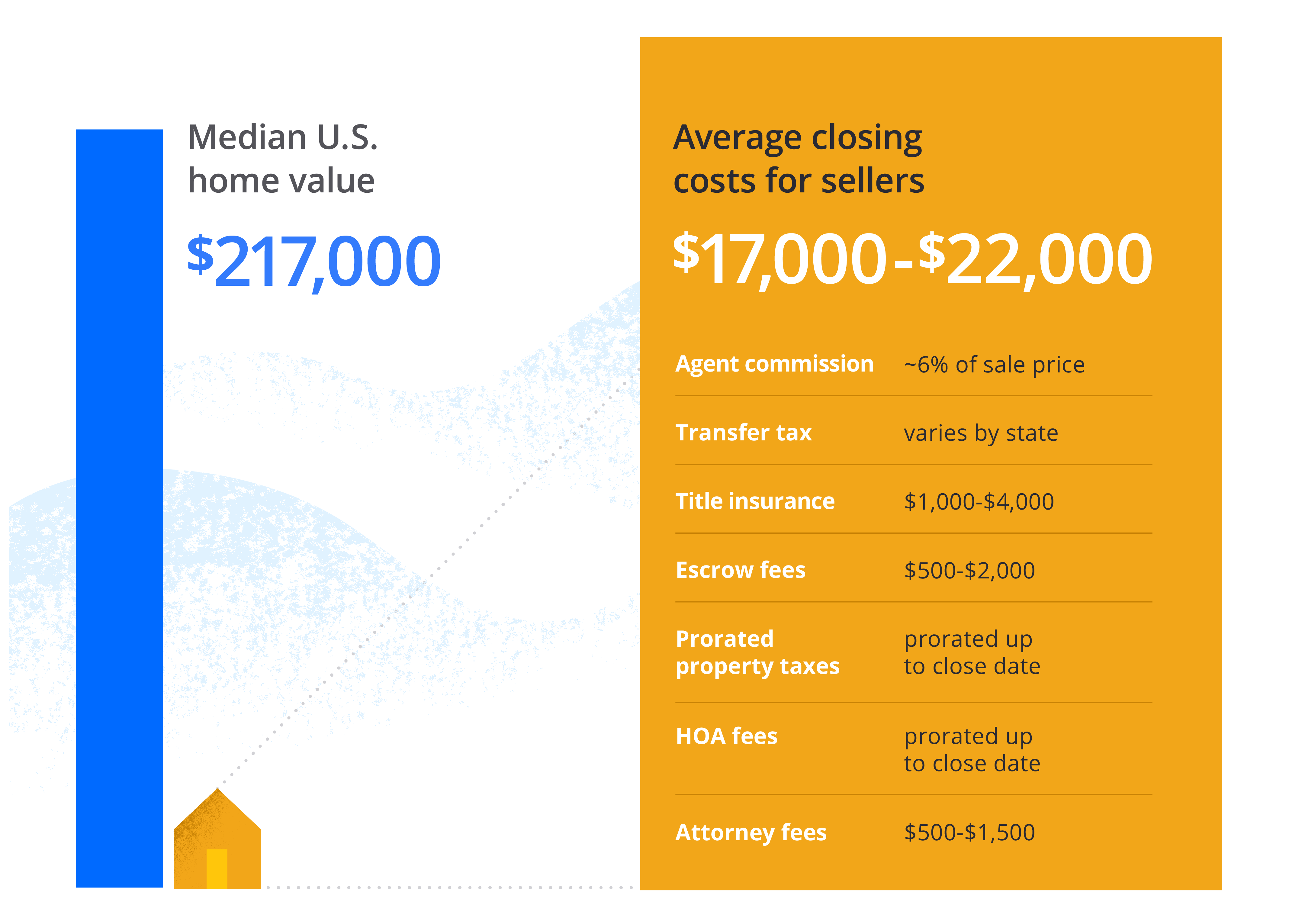

That is not a deductible moving expense. This commission can generally range between 5-6 of the propertys sale price for a full service broker but this percentage varies by state and even region. Or buyers your REALTORs services are technically free unless your house gets sold. You moved to your new home or new apartment to start a job or a business or to attend full-time post-secondary courses at a university college or other educational institution. Travel expenses for the move are deductible including transportation and lodging for you and members of your household including pets.

Source: rubyhome.com

Source: rubyhome.com

Many costs are deductible as moving expenses including. Commission fees generally range from 25 per cent to 395 per cent for the first 350k - 500k of the sale price then around 2 for anything over and above that. While the buyers will typically be responsible for the lions share sellers should expect to. Many costs are deductible as moving expenses including. Eligible moving expenses include real estate commissions and legal fees transportation and storage costs travel expenses including meals temporary living expenses utility hookup and.

Many costs are deductible as moving expenses including. Commission fees generally range from 25 per cent to 395 per cent for the first 350k - 500k of the sale price then around 2 for anything over and above that. The commission is calculated based on the percentage of the propertys sold price the percentage of which can be negotiated. Generally you can claim moving expenses you paid in the year if both of the following apply. Total deductible moving expenses line 3 8400 Minus.

Source:

Source:

Commission fees generally range from 25 per cent to 395 per cent for the first 350k - 500k of the sale price then around 2 for anything over and above that. SC LLR can assist you with examination information and materials continuing education requirements and. Generally you can claim moving expenses you paid in the year if both of the following apply. Eligible moving expenses Transportation and storage costs such as packing hauling movers in-transit storage and insurance for household items including boats and trailers. Travel expenses including vehicle expenses meals and accommodation to move.

Eligible moving expenses Transportation and storage costs such as packing hauling movers in-transit storage and insurance for household items including boats and trailers. Can you deduct a real estate brokers commission as part of my moving expenses when I moved to a new city and the broker found me my new apartment. Or buyers your REALTORs services are technically free unless your house gets sold. Transportation and storage costs for household effects travel including vehicle costs and reasonable costs for meals and accommodations in the course of moving the taxpayer and members of the taxpayers household from the old residence to the new residence. The commission is calculated based on the percentage of the propertys sold price the percentage of which can be negotiated.

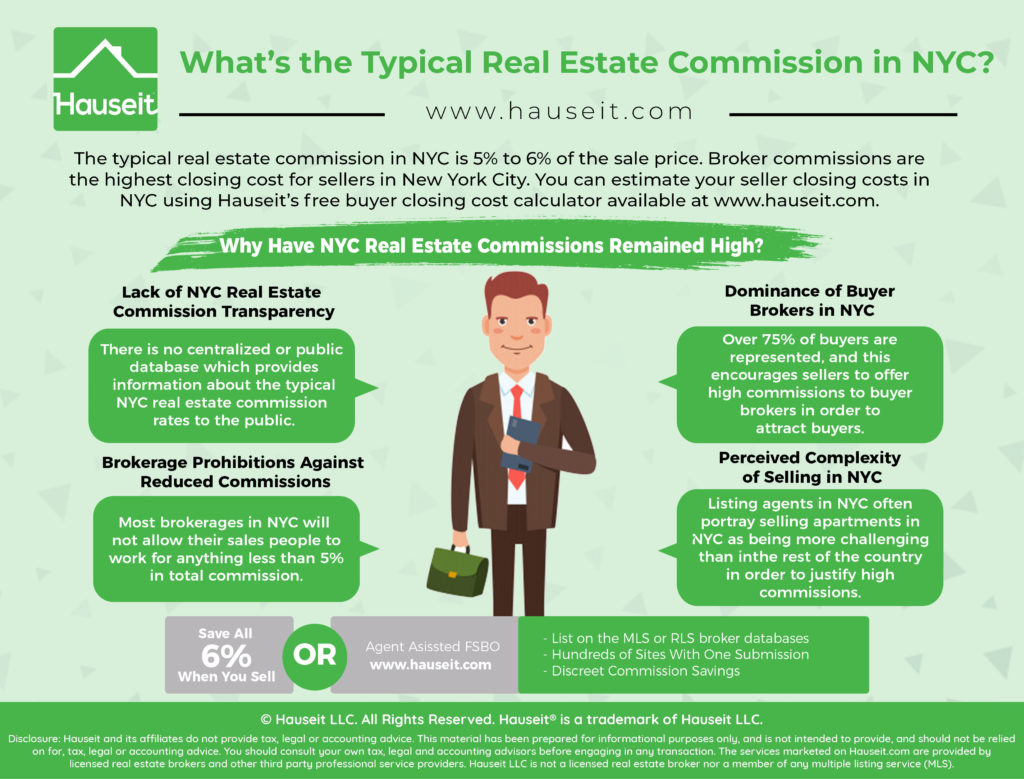

Source: hauseit.com

Source: hauseit.com

You may need to document that the move is required by your business. SC LLR can assist you with examination information and materials continuing education requirements and. You will find what is and is not a deductible moving expense in IRS Pub. The expenses must be itemized and only specific expenses may be paid. A real estate broker typically receives a real estate commission for successfully completing a sale.

Source: hauseit.com

Source: hauseit.com

This commission can generally range between 5-6 of the propertys sale price for a full service broker but this percentage varies by state and even region. The Real Estate Commission regulates Real Estate Brokers Salespersons and Property Managers and administers the registration of timeshare Projects and out-of-state subdivided land sales being marketed in the State of South Carolina. Travel expenses for the move are deductible including transportation and lodging for you and members of your household including pets. Closing costs are a blanket term for the various fees and expenses not including realtor commission paid by both parties at the close of a real estate transaction. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for.

Commission fees generally range from 25 per cent to 395 per cent for the first 350k - 500k of the sale price then around 2 for anything over and above that. Reimbursement included in box 13 of Form W-2 line 4 7200 Deduction for moving expenses line 5 1200. The reality isYou used to be able to deduct moving expenses if your new home was at least 50 miles closer to your new job than your old home was the distance test and youd been working that job full-time for 39 weeks within the first year after you moved the time test. Real estate commission is the payment to your real estate agent for the services rendered. The Real Estate Commission regulates Real Estate Brokers Salespersons and Property Managers and administers the registration of timeshare Projects and out-of-state subdivided land sales being marketed in the State of South Carolina.

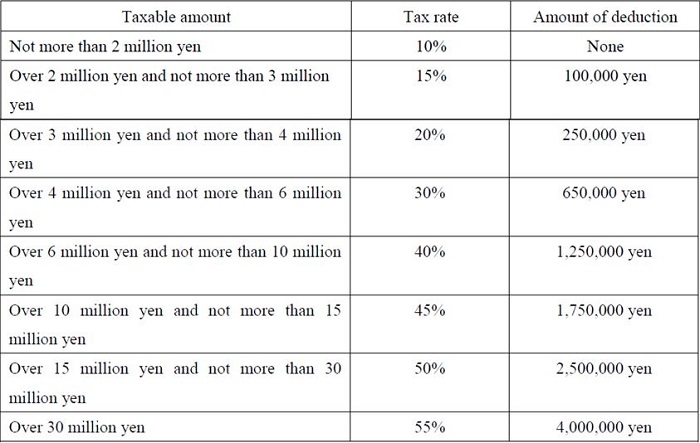

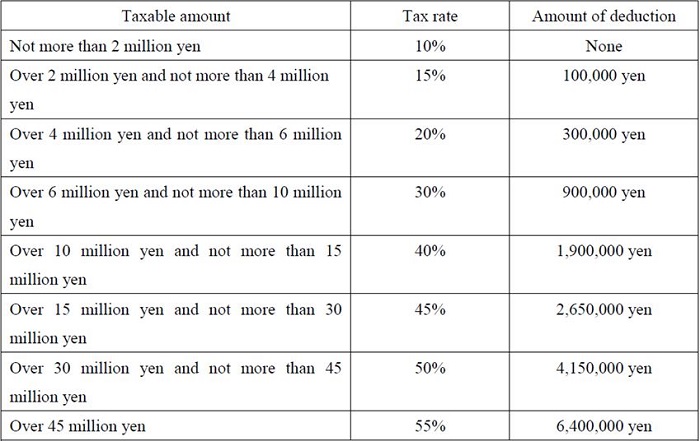

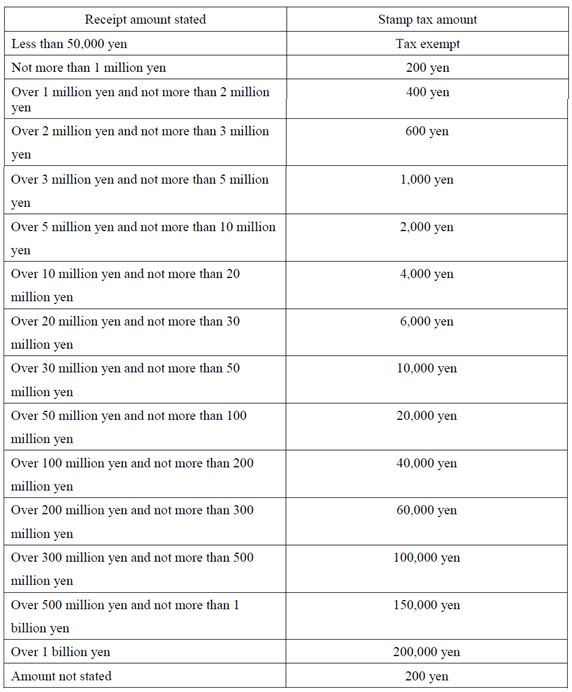

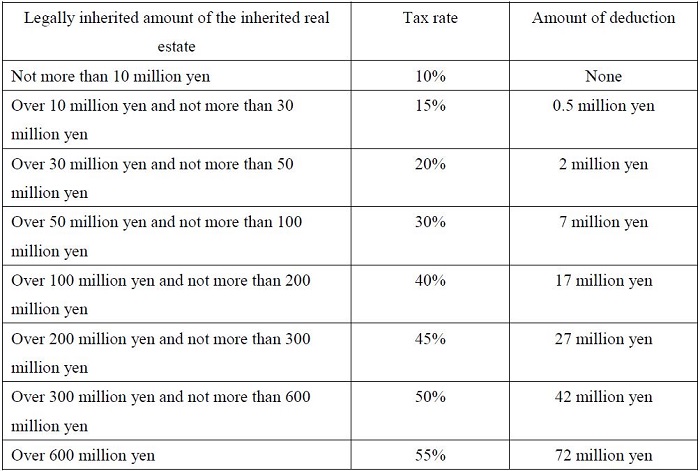

Source: tsunagulocal.com

Source: tsunagulocal.com

Can you deduct a real estate brokers commission as part of my moving expenses when I moved to a new city and the broker found me my new apartment. Eligible moving expenses include real estate commissions and legal fees transportation and storage costs travel expenses including meals temporary living expenses utility hookup and. Travel expenses for the move are deductible including transportation and lodging for you and members of your household including pets. SC LLR can assist you with examination information and materials continuing education requirements and. The reality isYou used to be able to deduct moving expenses if your new home was at least 50 miles closer to your new job than your old home was the distance test and youd been working that job full-time for 39 weeks within the first year after you moved the time test.

Source: zillow.com

Source: zillow.com

A real estate broker typically receives a real estate commission for successfully completing a sale. A real estate broker typically receives a real estate commission for successfully completing a sale. Reimbursement included in box 13 of Form W-2 line 4 7200 Deduction for moving expenses line 5 1200. You may need to document that the move is required by your business. You moved to work or to run a business or you moved to study courses as a full-time student enrolled in a post -secondary program at a university a college or another educational institution.

See 202031-1 through 202031-9. Eligible moving expenses Transportation and storage costs such as packing hauling movers in-transit storage and insurance for household items including boats and trailers. The Real Estate Commission regulates Real Estate Brokers Salespersons and Property Managers and administers the registration of timeshare Projects and out-of-state subdivided land sales being marketed in the State of South Carolina. While the buyers will typically be responsible for the lions share sellers should expect to. The expenses must also be for a business purpose.

Source: pinterest.com

Source: pinterest.com

Real estate commission is the payment to your real estate agent for the services rendered. You moved to your new home or new apartment to start a job or a business or to attend full-time post-secondary courses at a university college or other educational institution. Travel expenses including vehicle expenses meals and accommodation to move. Travel expenses for the move are deductible including transportation and lodging for you and members of your household including pets. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for.

From the CRA documentation for Moving Expenses. Transportation and storage costs for household effects travel including vehicle costs and reasonable costs for meals and accommodations in the course of moving the taxpayer and members of the taxpayers household from the old residence to the new residence. You will find what is and is not a deductible moving expense in IRS Pub. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for. While the buyers will typically be responsible for the lions share sellers should expect to.

Real estate commission is the payment to your real estate agent for the services rendered. You moved to your new home or new apartment to start a job or a business or to attend full-time post-secondary courses at a university college or other educational institution. Travel expenses including vehicle expenses meals and accommodation to move. Transportation and storage costs for household effects travel including vehicle costs and reasonable costs for meals and accommodations in the course of moving the taxpayer and members of the taxpayers household from the old residence to the new residence. Generally you can claim moving expenses you paid in the year if both of the following apply.

Source: zillow.com

Source: zillow.com

Eligible moving expenses Transportation and storage costs such as packing hauling movers in-transit storage and insurance for household items including boats and trailers. From the CRA documentation for Moving Expenses. Can you deduct a real estate brokers commission as part of my moving expenses when I moved to a new city and the broker found me my new apartment. But moving expenses can also include ancillary costs such the cost of cancelling the lease for your old home as well as other incidental costs related to your move such as fees paid to change your address on legal documents replace your drivers license and utility hook-ups and disconnections for. Total deductible moving expenses line 3 8400 Minus.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title moving expenses real estate commission by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.